Rateseeker Round-up: June Property News

As we approach the midway point of the year, the real estate market shows no signs of slowing down. Property values surged across Australia and, in turn, set new records for the rate of growth. In line with these rising prices, the Federal Government will soon commence openings in three different assistance programs aimed at first home buyers and single parents.

Missed the biggest news? You’ll find it all here. In this post, we round up the four biggest property updates from June.

Government to kickstart new programs aimed at first home buyers and single parents

Earlier this year, the Federal Government announced new initiatives to support single parents, and extensions to existing initiatives for first home buyers. Openings for these initiatives will be released on 1 July,

These include:

- First Home Loan Deposit Scheme (FHLDS). This will allow 10,000 first home buyers to purchase existing homes with a 5% deposit, without needing to pay Lender’s Mortgage Insurance (LMI).

- FHLDS New Home Guarantee. 10,000 more spots have opened up for first home buyers to buy or build new homes with a 5% deposit. Like the FHLDS, buyers won’t need to pay Lender’s Mortgage Insurance (LMI) on these loans.

- Family Home Guarantee. 10,000 spots will be available for single parents with dependents to purchase a property with a 2% deposit, without having to pay Lender’s Mortgage Insurance. This is open to first home buyers and previous home owners, provided they can demonstrate they do not currently own property.

All of these schemes have price caps, which vary depending on the state or territory. From 1 July, these will be increased for the First Home Loan Deposit Scheme and Family Home Guarantee to make them easier to access.

Loyal to your bank? You may be paying higher interest rates

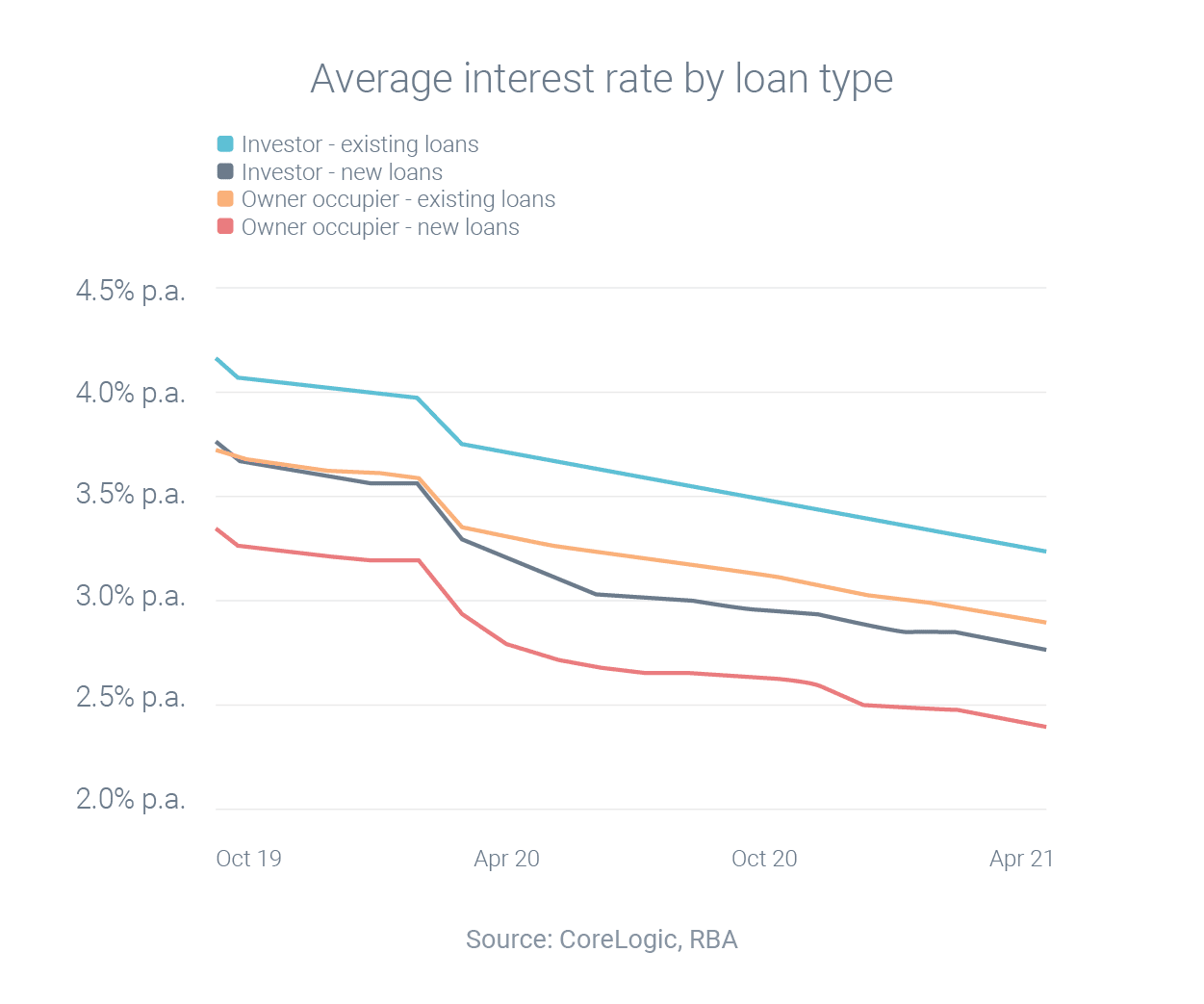

Most mortgages have a loan term spanning 10+ years, but this doesn’t mean you should stick with the same lender throughout your loan. New data from CoreLogic reveals that loyal borrowers pay more than those who shop around.

Owner-occupiers who took out new variable loans in April were charged an average interest rate of 2.77% p.a. However, owner-occupiers with existing variable mortgages were charged an average of 3.10% p.a. – a loyalty tax of 0.33 percentage points.

Investors pay an even larger loyalty tax of 0.38 percentage points, with variable loans priced at 3.06% for new borrowers and 3.44% for existing borrowers.

These figures highlight the importance of refinancing your mortgage. For example, for a $500,000 mortgage, these small differences in interest rate can add up to tens of thousands over the life of the loan:

- You pay $31,887 less interest over 30 years with a rate of 2.77% p.a. rather than 3.10% p.a.

- You pay $37,539 less interest over 30 years with a rate of 3.06% p.a rather than 3.44% p.a.

Ready to refinance? Speak to one of our brokers today, and we’ll help you find the sharpest home loan refinance rate in Australia.

Banks encouraged to keep lending standards high

With the property market booming, the Reserve Bank of Australia has reminded lender’s to continue rigorously assessing home loan applications. The exact criteria for home loans will differ depending on the lender, but it is typically based on three core factors:

- Employment status and income

- Savings and credit history

- Existing loans and equity

“It is important that lending standards remain sound in an environment of low interest rates and rising housing prices. The RBA does not, and should not, target housing prices. We do, though, have a strong interest in trends in household borrowing, especially given the already high level of household debt in Australia.”

Reserve Bank governor Philip Lowe

Applying for a home loan? Don’t make these 12 common mistakes.

Property market continues upward trajectory

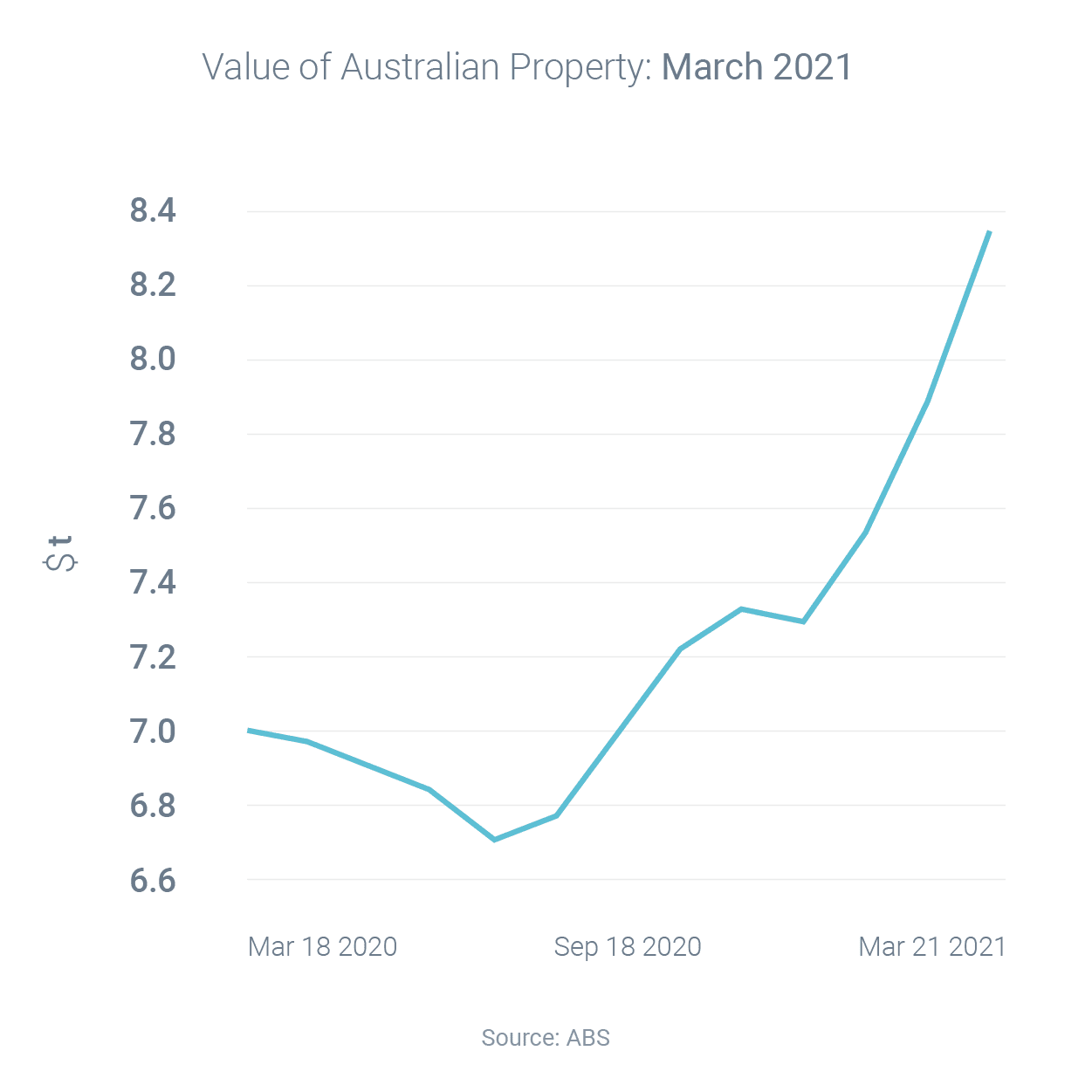

Despite being in the middle of a global pandemic, the value of residential dwellings in Australia keeps going up. The Australian housing market has surpassed $8 trillion for the first time, according to new data from the Australian Bureau of Statistics (ABS).

In Q2, the total value of Australia’s 10.6 million homes rose by $449.9 billion, which is the biggest jump on record. National property prices also rose 5.4%, which is the fastest rate of growth since December 2009.

Of the capital cities, Sydney and Hobart saw the highest rate of growth, followed by Canberra and and Perth:

- Sydney = 6.1%

- Hobart = 6.1%

- Canberra = 5.6%

- Perth = 5.2%

- Melbourne = 5.1%

- Darwin = 4.7%

- Brisbane = 4.0%

- Adelaide = 4.0%

** General Advice Warning

The information provided on this website is general in nature only and it does not take into account your personal needs or circumstances into consideration. Before acting on any advice, you should consider whether the information is appropriate to your needs and where appropriate, seek professional advice in relation to legal, financial, taxation, mortgage or other advice.