Rateseeker Spring Update: Borrowing Power, Offsets, Property Prices & Credit Trends

The Reserve Bank of Australia’s September 30 cash rate call will no doubt dominate the headlines. But while the RBA’s decisions are always important, there are other economic and financial stories that matter just as much for your borrowing power, household budget, and property decisions this spring.

This month’s update dives into four key trends shaping the financial landscape:

- Mortgage arrears are near record lows, with most Australians paying on time

- Offset balances are rising, reducing the interest households pay

- Property prices have risen for seven straight months despite softer conditions elsewhere

- Credit card use continues to decline, with implications for household debt and loan eligibility

Taken together, these insights reveal a financial system that is surprisingly resilient, even in a period of uncertainty. Let’s explore each of these stories in detail.

Fewer Borrowers Falling Behind on Mortgages

Mortgage stress is always a hot topic in Australia, but right now, the news is unexpectedly positive. According to the Australian Prudential Regulation Authority (APRA), the share of home loans that were 30–89 days late fell from 0.66% in June 2024 to 0.55% in June 2025.

To put that another way: more than 99 out of 100 borrowers are fully up to date on their repayments.

Several factors are contributing to this resilience:

- Lower interest rates in 2025: Three cash rate cuts this year have helped reduce monthly mortgage costs.

- Better budgeting: Many households have adjusted to higher living costs by cutting discretionary spending and prioritising debt repayments.

- Different borrower strategies: APRA data shows a mixed picture in new lending. On one hand, more Australians are putting down bigger deposits (69.6% of borrowers had at least a 20% deposit in June 2025, compared with 68.1% in 2024). On the other hand, a small but growing share (5.5%) are taking on higher leverage, with debt-to-income ratios above six times.

This demonstrates the diversity of approaches in today’s market. Some borrowers are prioritising financial safety nets, while others are maximising purchasing power.

What this means for you:

If you’re planning to buy or refinance, the data shows lenders are still comfortable with the market and willing to extend credit. A strong repayment history and a sensible deposit strategy will continue to strengthen your application.

Rising Offset Balances Are Easing Mortgage Pain

Another striking trend is the growth in offset savings. APRA data shows that in the June quarter, borrowers held an average of $11,435 in offset accounts for every $100,000 of their home loan balance – up from $10,647 a year earlier.

That might not sound like much, but it makes a significant difference.

How an Offset Works

An offset account is a bank account linked to your home loan. Whatever you keep in it directly reduces the balance on which your interest is calculated.

For example:

- Loan: $500,000

- Offset balance: $20,000

- Interest charged: $480,000 (not $500,000)

On a 30-year loan at 5.68%, this could save you more than $100 per month in interest.

When Offset Accounts Shine

- You hold a decent level of savings or regular cash flow

- You want flexibility – being able to access funds while still cutting interest

- You prefer reducing debt faster without locking money away

When It May Not Be Worth It

- Your balance is consistently low (fees may outweigh savings)

- A basic loan with a lower interest rate could save more overall

Takeaway: If you’re sitting on savings, keeping them in an offset account can be one of the smartest ways to minimise mortgage costs – especially in today’s interest rate environment.

Property Prices Rise for the Seventh Straight Month

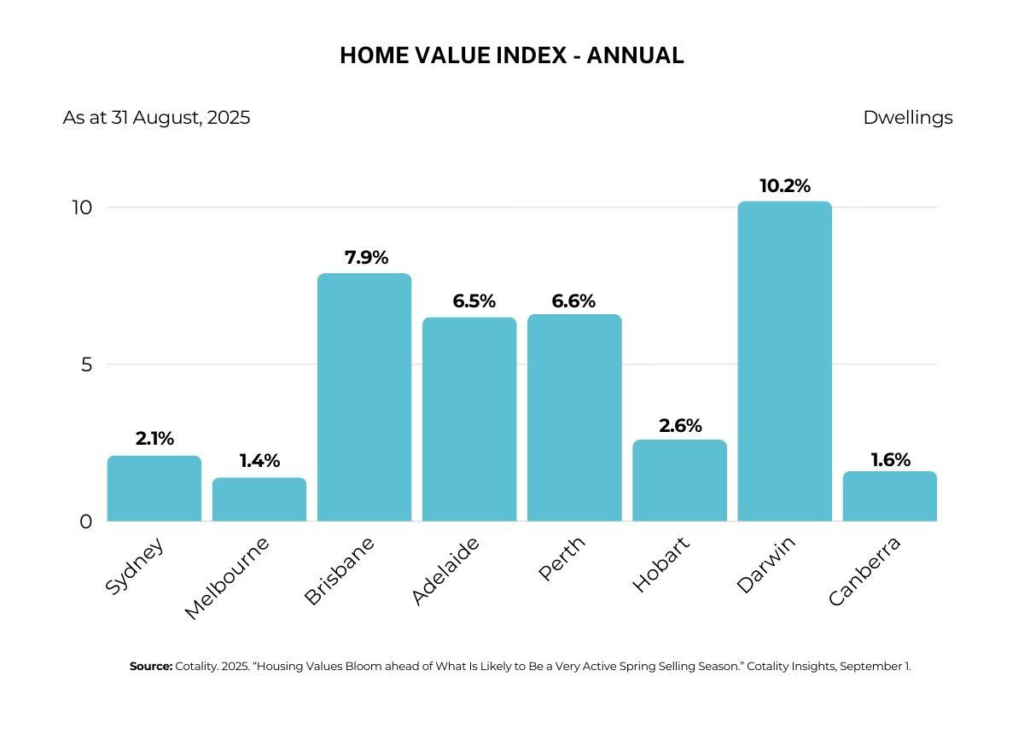

Despite talk of affordability challenges and higher living costs, Australian property prices continue to defy expectations. According to Cotality, median prices rose another 0.7% in August 2025, marking the seventh consecutive monthly increase.

What’s Driving the Growth?

- Interest rate cuts: The three RBA reductions in 2025 have directly boosted borrowing capacity.

- Wages outpacing inflation: With real wages growing, buyers can service larger loans.

- Supply shortages: Demand is running 4% above the five-year average, while listings remain about 20% below the seasonal norm.

This imbalance is keeping upward pressure on prices, even as conditions differ across states and suburbs.

Why Get Pre-Approval Before House Hunting?

- Show you’re serious: Sellers and agents often prefer dealing with buyers who have finance already lined up.

- Know your limit: Pre-approval helps you avoid wasting time on properties outside your budget.

- Move fast: When your dream home comes up, you can make a firm offer without waiting for lender approval.

- Strengthen your offer: A pre-approval can put you ahead in competitive bidding situations.

Insight: While the market is patchy, the combination of lower rates, improving wage growth, and constrained supply suggests continued price momentum through spring. Having finance ready will be key to moving quickly.

Australians Using Less Plastic

Another shift that’s flying under the radar: Australians are relying less on credit cards.

According to the Reserve Bank of Australia (RBA), the number of personal credit cards in circulation in July 2025 was 1.7% lower than the year before, while balances accruing interest fell 0.4% year-on-year.

This reflects a slow but steady cultural change in household finance – more people are choosing debit, savings, or buy-now-pay-later over traditional credit.

Why This Matters for Borrowers

- Safer profile: Lenders view fewer credit cards and lower limits as less risky.

- Higher borrowing power: Reduced credit liabilities mean banks are willing to lend more.

- Simpler finances: With fewer accounts to manage, households can stay more organised.

Tip: If you’re planning a mortgage application, consider reducing credit card limits or closing unused accounts. This can improve your serviceability and strengthen your loan application.

Big Picture: Resilience Amid Uncertainty

Taken together, these four stories point to an economy and property market that is more resilient than many expected:

- Mortgage arrears are at historically low levels

- Households are proactively using offsets to cut costs

- Prices are rising steadily despite challenges

- Credit card use is falling, improving financial health

At the same time, challenges remain: wages growth must remain sustainable, inflation risks could re-emerge, and supply constraints will continue to affect affordability.

Final Word

Spring is traditionally one of the busiest seasons for property and lending. With rates still relatively low, wages rising, and housing demand exceeding supply, the conditions are lining up for a dynamic market.

Whether you’re considering refinancing, buying your first home, or investing in property, now is the time to review your loan strategy and financial goals.

If you’d like tailored advice on how these trends might affect your situation, I’d be happy to help.

Contact Rateseeker today to review your borrowing power, compare loan options, and take advantage of the opportunities this spring.

Disclaimer: This newsletter is general information only and does not constitute financial advice. You should seek professional advice before making any financial decisions.

** General Advice Warning

The information provided on this website is general in nature only and it does not take into account your personal needs or circumstances into consideration. Before acting on any advice, you should consider whether the information is appropriate to your needs and where appropriate, seek professional advice in relation to legal, financial, taxation, mortgage or other advice.