Rateseeker September 2022 Business News Round-up

Spring is in the air, and with this our top stories this month include businesses being warned about intellectual property risks along with good news for local businesses as parliament introducing small business tax incentives. In other news, recent data from the ABS shows consumers have been embracing retail therapy as sales surge, as gross operating profits sit above or below previous quarters for various industries.

Missed the latest news? Here are the biggest stories below.

Intellectual property at risk for businesses

Has your business secured a shorter ‘.au’ domain name recently?

If you haven’t, you may want to take action as the exclusivity period has just come to an end. This means that anyone with an existing Australian domain name (e.g. yourbusiness.com.au) has exclusive rights until September 20th to register the ‘.au’ version ( yourbusiness.au).

Since the exclusivity period has ended, the floodgates are open, and there’s nothing to stop rivals, cybersquatters, scammers snapping up or domain-parking the ‘.au’ version of your business name.

Small business ombudsman Bruce Billson has warned of the potential consequences of not taking action.

“Ask yourself, would I be upset if someone else had the ‘.au’ version of my existing domain name? Would I feel the digital engagement I’ve developed with my customers would be compromised if I didn’t have that abridged version?

If you don’t get control of the ‘.au’ version of your domain name, a cybercriminal masquerading as you could try to reach your customers to harvest personal information, even intercept invoices so that they can substitute different bank account details.“

Bruce Billson – small business ombudsman

Parliament to introduce tax incentives for small businesses

The federal government has introduced draft legislation for two tax incentives designed to help businesses train employees and improve their digital capacity.

The Technology Investment Boost will let small businesses deduct an additional 20% of the cost incurred on business expenses and depreciating assets that support their digital adoption, such as portable payment devices, cyber security systems or subscriptions to cloud-based services.

- The measure will apply from 29 March 2022 to 30 June 2023

- An annual $100,000 cap will apply to each qualifying income year

- Businesses can continue to deduct expenditure over $100,000 under existing tax law

- Businesses can continue to deduct expenditure that is ineligible for the bonus deduction in accordance with the existing tax law

The Skills and Training Boost will let small businesses deduct an additional 20% of expenditure incurred on eligible training courses provided to employees.

- The measure will apply from 29 March 2022 to 30 June 2024

- Businesses can continue to deduct expenditure that is ineligible for the bonus deduction in accordance with the existing tax law

Both incentives were announced in the March federal Budget by the previous government.

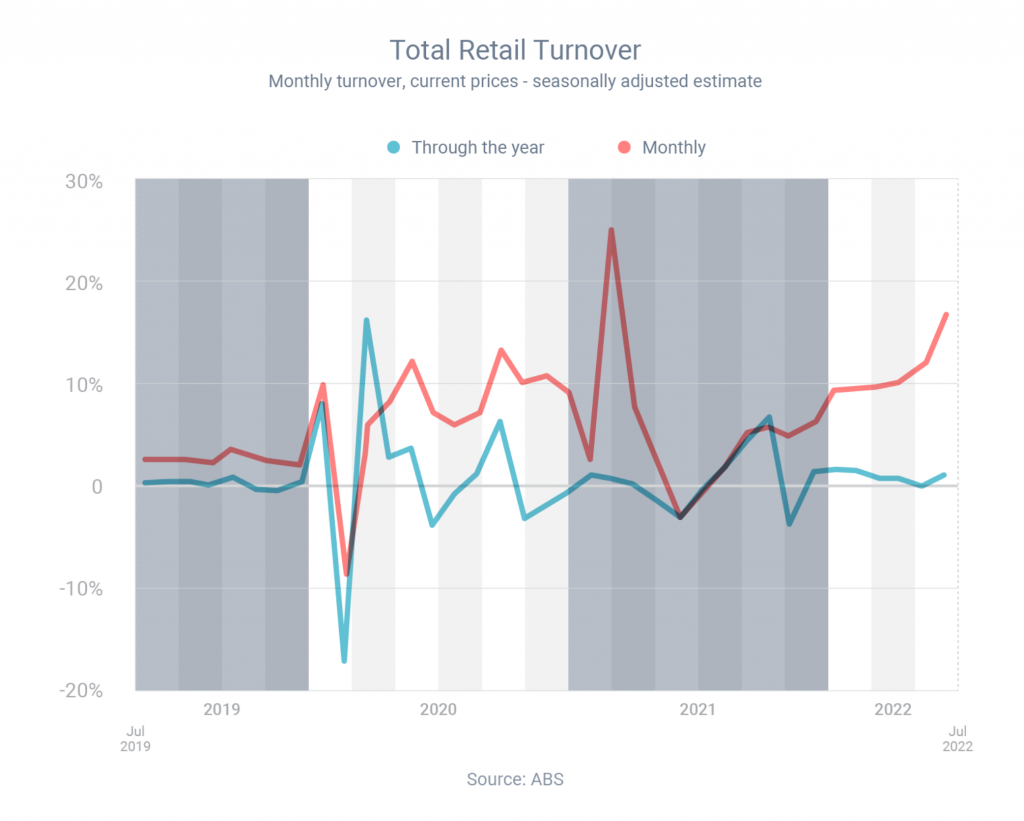

Aussie consumers indulge in retail therapy

With good news for the retail industry, Aussie consumers are taking their turn in indulging in retail therapy. Australia’s retail businesses have enjoyed their seventh month in a row of increased turnover, according to recent data from the Australian Bureau of Statistics.

Aussie retailers made $34.7 billion of sales in July, which was 1.3% higher than the previous month and 16.5% higher than the year before.

Turnover increased year-on-year for all six retail industry groups below:

- Clothing, footwear & personal accessory retailing up 52.6%

- Cafes, restaurants & takeaway food services up 45.9%

- Department stores up 35.6%

- Other retailing up 17.7%

- Household goods retailing up 10.5%

- Food retailing up 3.2%

Turnover also increased in all Australian states and territories:

- New South Wales up 23.5%

- Victoria up 16.9%

- South Australia up 15.6%

- Queensland up 12.8%

- Western Australia up 10.5%

- Tasmania up 4.7%

- Northern Territory up 4.3%

- ACT up 4.2%

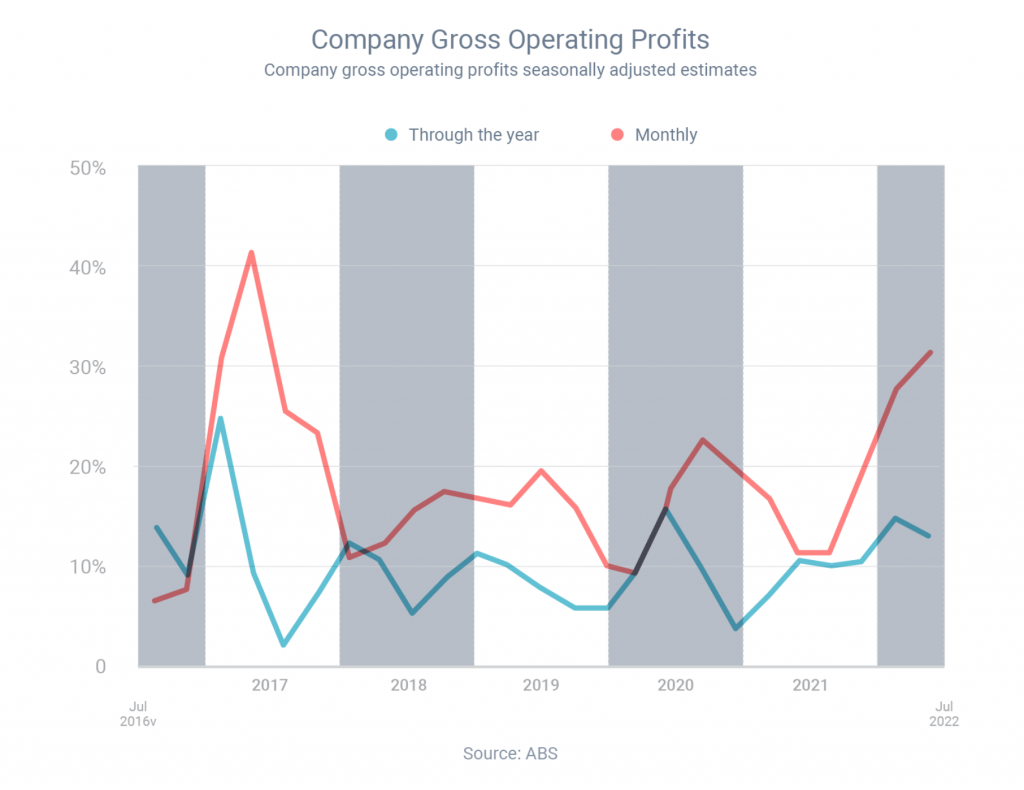

Profits grow and shrink depending on industry

In the world of finance, a year can make a huge difference.

In June 2022 company gross operating profits had increased 28.5% compared to the year before, according to recent data from the Australian Bureau of Statistics.

The significant increase was expected, given that Sydney, Melbourne and other parts of the country were under lockdown in June last year, responsible for the restricted business activity and decreased economic activity.

In saying this, the results in June this year were also 7.6% higher than the previous quarter, a significant change.

It is interesting though, that only seven industries enjoyed quarter-by-quarter increases in gross profits:

- Accommodation & food services up 48.8%

- Transport, postal & warehousing up 23.8%

- Mining up 14.3%

- Manufacturing up 10.0%

- Arts & recreation services up 1.5%

- Wholesale trade up 1.1%

- Electricity, gas, water & waste services up 0.4%

On the other hand, eight industries experienced quarterly falls in gross profits:

- Financial & insurance services down 38.0%

- Rental, hiring & real estate services down 8.5%

- Information media & telecommunications down 6.8%

- Other services down 6.6%

- Construction down 5.7%

- Retail trade down 5.0%

- Professional, scientific & technical services down 2.7%

- Administrative & support services down 0.1%

Need a business loan or looking to enter the property market as an investor? We can help, our expert financial advisors and brokers can help kickstart your journey into building wealth through property and provide trusted financial advice.

Simply head over to our contact us page and get in touch with us here.

** General Advice Warning

The information provided on this website is general in nature only and it does not take into account your personal needs or circumstances into consideration. Before acting on any advice, you should consider whether the information is appropriate to your needs and where appropriate, seek professional advice in relation to legal, financial, taxation, mortgage or other advice.