Rateseeker Round-Up: FY26 Kickoff Newsletter

Big news as the new financial year begins: interest rate cuts, falling fixed rates, soaring rents, and tax time preparation. Here’s what you need to know.

Case Builds for an Extra Rate Cut

The Reserve Bank of Australia (RBA) has been keeping a close eye on inflation and domestic growth, and for the first time in years, the stars appear to be aligning for another round of rate relief.

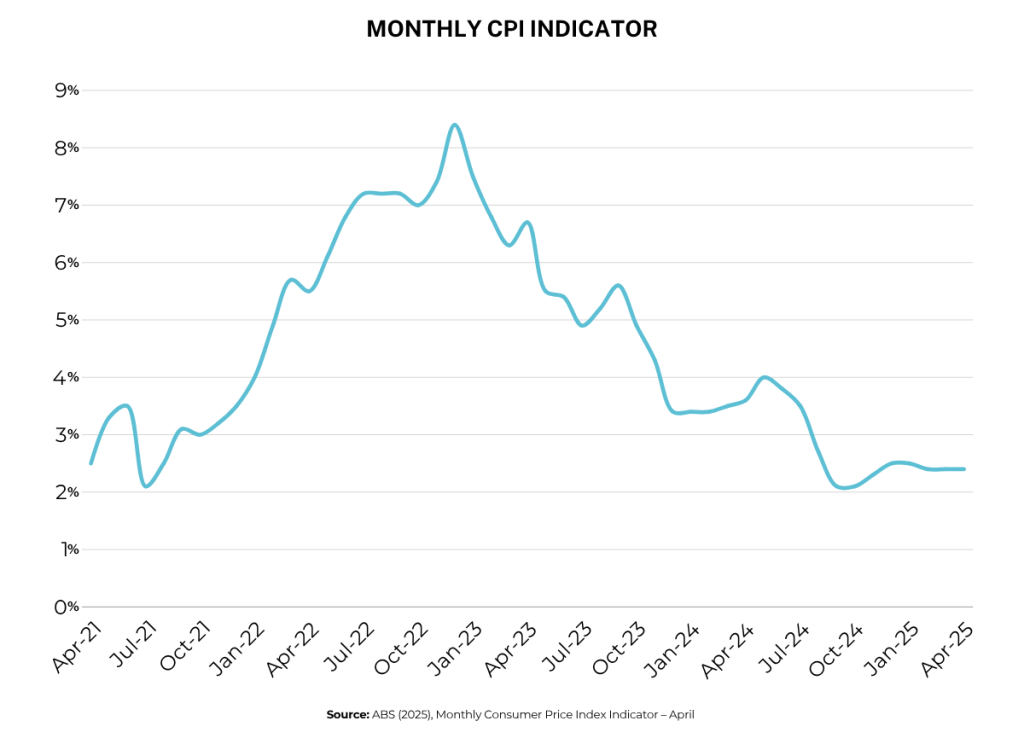

In April, the annual inflation rate slowed to 2.4%, marking the ninth consecutive month that headline inflation has sat within the RBA’s official target band of 2–3%. This is an important milestone: just two years ago, inflation was running above 7%, forcing the RBA to embark on an aggressive tightening cycle that pushed the cash rate sharply higher.

Even more significant is the trimmed mean inflation rate, the RBA’s preferred measure that strips out volatile items like fuel and fresh food. At 2.8%, it has now remained within the target range for five straight months. That stability gives the RBA more confidence that inflation is not just moderating temporarily but may be under control for the medium term.

In the minutes of its May 20 policy meeting, the RBA board acknowledged that inflationary pressures have eased significantly. They also flagged concerns about “significant and unexpectedly adverse developments in the global economy” that could further slow domestic growth. This, in turn, could place additional downward pressure on inflation, reinforcing the case for a rate cut.

But it’s not all smooth sailing. The RBA warned of upside risks to inflation, particularly with the scheduled expiry of federal energy subsidies, which will lift household power bills, and the persistent tightness of the labour market, which is driving wages higher.

What this means for households and businesses

- Borrowers: Another cut would ease mortgage pressures slightly, though any move is likely to be incremental.

- Businesses: Lower borrowing costs could free up cash flow, but weaker household spending remains a drag on sales.

- Investors: A cut could boost asset markets, supporting property prices and equities.

For now, most economists expect at least one more cut this year, but how far the RBA goes will depend on global conditions and the persistence of wage-driven price pressures.

Fixed Rates Fall to Three-Year Lows

In a surprising twist, fixed mortgage rates are once again becoming competitive. In fact, some lenders are now offering fixed rates starting with a “4”, while variable rates remain stubbornly in the “5” range.

This is the first time in three years that fixed products have dipped this low, raising the question: is it time to fix?

The case for staying variable

- If the RBA cuts again in 2025, variable borrowers will benefit immediately, while fixed borrowers will be locked into current levels.

- Variable loans usually come with more flexibility, including redraw facilities and offset accounts, which help manage cash flow.

- If the economy weakens further, variable borrowers stand to gain more from future rate reductions.

The case for fixing now

- Since early 2024, lenders have often priced fixed loans cheaper than variable, according to RBA data. That trend continues, suggesting fixed borrowers could be paying less from day one.

- Fixed repayments provide certainty in an uncertain economy, helping households budget during a period of high living costs.

- With lenders competing aggressively for fixed borrowers, some are offering attractive incentives, such as cashbacks or reduced fees.

A balanced view

For many households, a split loan (part fixed, part variable) could offer the best of both worlds. It provides some certainty while leaving scope to benefit if rates fall further.

Ultimately, the right choice depends on your financial position, risk tolerance, and time horizon. If you’re unsure, it’s worth reviewing your options now that the fixed-rate landscape is shifting.

Rental Growth Continues

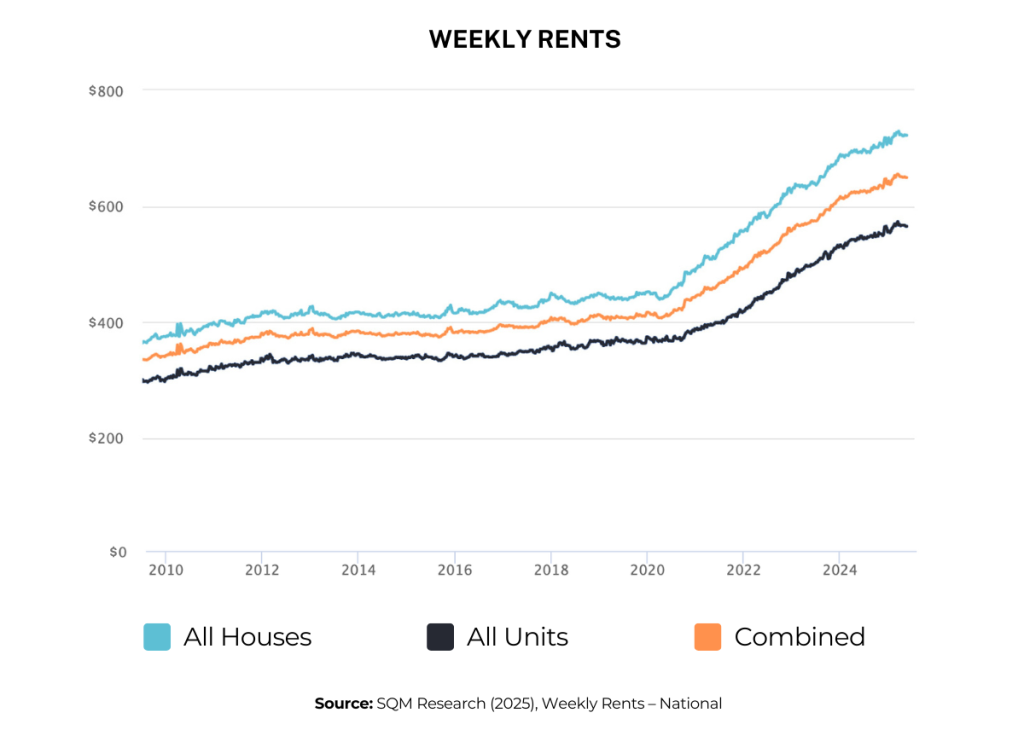

Australia’s rental market remains one of the hottest economic stories of the year.

According to SQM Research, national rents climbed another 4.2% in the year to June 12, adding to the pressure renters have felt since the market began tightening in 2021. Vacancy rates remain stubbornly low in most capitals, ensuring competition for available properties is fierce.

For renters

- Rising rents mean household budgets are under increasing strain.

- Saving for a deposit is tougher, but strategies like shared living, suburb flexibility, and first home buyer schemes may help.

- Government policies, including rental assistance and potential supply-side initiatives, may ease some pressure, but meaningful relief will depend on new housing construction.

For investors

- Higher rents mean stronger yields, especially in markets where capital growth is also rebounding.

- With property prices stabilising, investors are seeing an opportunity to enter the market and leverage rising rental income.

- Equity release strategies (using your existing home’s value as security) are increasingly popular for funding deposits on investment properties.

Key takeaway

Whether you’re a tenant or an investor, the rental market highlights the importance of long-term planning. Renters who can save even modestly are better placed to escape rising rents, while investors can take advantage of current dynamics to build wealth.

Five Simple Steps to Succeed at Tax Time

As we approach the end of FY25, it’s time to get organised for tax season. Good preparation can make all the difference, not only by reducing stress but also by ensuring you maximise deductions.

Here are five essential steps:

- Gather paperwork early

- Collect income statements, PAYG summaries, loan documents, dividend statements, and receipts for deductible expenses.

- The more complete your records, the easier it is for your accountant to lodge accurately.

- Update personal details

- Make sure your bank account and myGov details are correct. Errors here can cause delays in receiving refunds.

- Check eligible deductions

- Work-from-home expenses, self-education costs, and investment property outgoings may all be claimable.

- Keep receipts and use the ATO’s myDeductions tool to stay compliant.

- Seek expert advice

- A qualified accountant can ensure you don’t miss opportunities and can help you structure your finances for the year ahead.

- Plan for the future

- Tax time is not just about compliance, it’s an opportunity to review your financial goals, budget, and investment strategy for FY26.

By taking these steps, you’ll enter the new year with confidence and clarity.

Wrapping Up: What This Means for FY26

As FY26 begins, Australia faces a mixed economic landscape:

- Inflation is back under control, but growth is fragile.

- The RBA is leaning towards more rate cuts, but global risks could change the picture quickly.

- Fixed mortgage rates are becoming attractive again, offering opportunities for savvy borrowers.

- Renters face continued challenges, while investors enjoy stronger yields.

- Tax time preparation remains critical for households and businesses alike.

The common theme? Preparation and flexibility. Whether you’re managing a mortgage, planning an investment, or just trying to stay on top of cost-of-living pressures, now is the time to get ahead of the curve.At Rateseeker, we specialise in helping Australians make informed financial decisions. From finding the right home loans to navigating property opportunities. If you’d like tailored advice, don’t hesitate to get in touch.

** General Advice Warning

The information provided on this website is general in nature only and it does not take into account your personal needs or circumstances into consideration. Before acting on any advice, you should consider whether the information is appropriate to your needs and where appropriate, seek professional advice in relation to legal, financial, taxation, mortgage or other advice.