Rateseeker March Property News Round-up 2023

With recent activity in the property market favouring investors, creating havoc for renters, home buyers and sellers are yet to see the true impact of the rising interest rates and how it will affect the next cycle of the market.

Data has revealed that despite property prices continuing to drop, property prices have taken a turn in some areas over the last few weeks. Although it’s too early to tell yet if we’ve reached the bottom of the market, active investors and aspiring homebuyers should keep their eyes peeled on the market insights to determine if they should make their next move.

Good news for first home buyers, research from Domain has shown that it is now significantly easier to save for a deposit for those looking to enter the property market for the first time.

Over the last month the Reserve Bank of Australia has suggested that with monetary policy now in “restrictive territory”, interest rates may be nearing their peak. Could this be the break Aussie home owners have been asking for?

Although the number of dwellings listed for sale has risen, home owners are reluctant to list their properties for sale. The increase of listings is due to less new listings coming onto the market than current listings taking longer to sell. This could mean as property prices increase, better listings are likely to be available to prospective buyers.

Check out the latest property news and the biggest stories below:

Have we reached the dip in the property market?

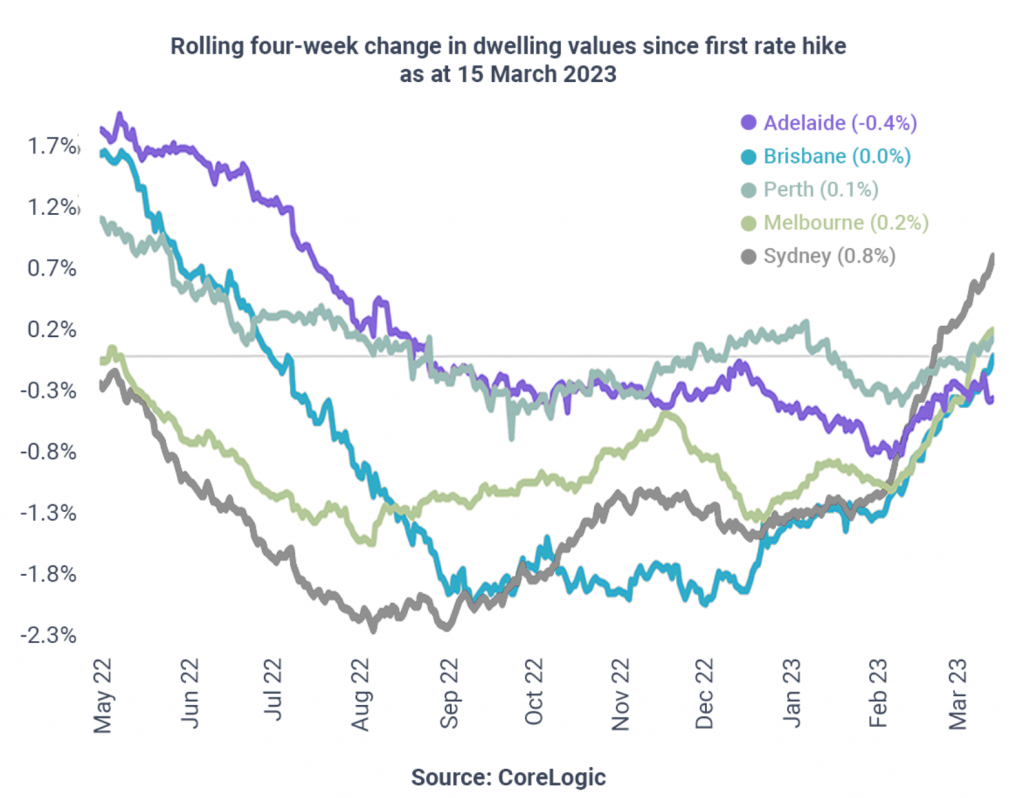

Recent data from CoreLogic Australia has revealed that we may be near the end of the housing downturn.

Although Australia’s average property price dropped 0.1% last month in February, dwelling values took a turn and rose in some markets in the four weeks to mid-march.

Experts however, say it is too early to determine if the market has seen its lowest point yet as interest rates may rise further and additionally, the full effects of the previous rate hikes and impact on households across the country may not be seen yet.

Sydney – up 0.8%

Melbourne – up 0.2%

Perth – up 0.1%

Brisbane – unchanged

Adelaide – down 0.4%

Buyers and homeowners should be looking at key metrics such as a surge of new property listings, with an increase in supply leading to a subsequent increase in demand. This could indicate that the recent trend of growth has lost its momentum.

Interest rates may rise further from here, as well as the fact that we are yet to see the full impact on households from the aggressive rate hiking cycle to date.

Additionally, economic conditions are set to weaken through the middle of the year, as household savings buffers are being depleted and labour markets are likely to loosen further.

Tim lawless – Corelogic Australia Executive Research Director

With interest rates possibly on the rise and many fixed term loans ending, it’s a great time to give your mortgage a health check and see if you’re able to save thousands on your home loan in the long-term. Simply get in touch for an obligation free chat and our mortgage experts can help determine if you’re in the right circumstances to seek a sharper rate and benefit.

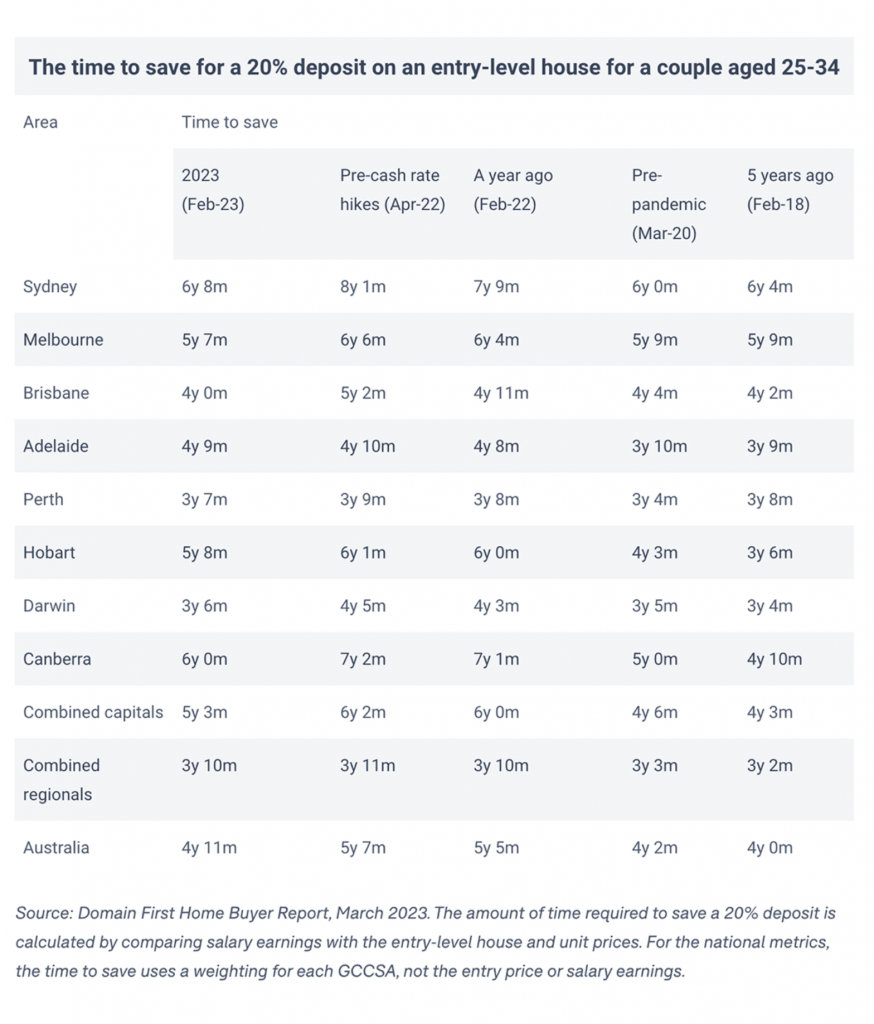

First home buyers now require less time to save for their home deposit

According to new data from Domain, over the last 12 months it has become significantly easier for first home buyers to save a 20% house deposit.

In February last year, first home buyers needed an average of 5 years 5 months to save a 20% deposit for a house, however by February 2023, that number has dropped to 4 years 11 months.

Naturally this has also meant that it has become easier for first home buyers to save a 20% unit deposit, with the average time falling from 3 years 9 months to 3 years 7 months.

Figures above have been calculated by Domain on the average income and purchase price of first home buyers by assuming they were a couple aged between 25-34 years and were purchasing an entry-level property.

The primary reason first home buyers now require less time to save a deposit is due to property prices having fallen over the past year, meaning the deposit requirement has also been lowered.

If you’re looking to enter the property market for the first time or have a friend or family member who is, our team at Rateseeker can help. We’re experts at helping Aussies open doors to their news homes and securing the sharpest rates available. Simply get in touch for an obligation free chat and we can help determine what your most favourable options are.

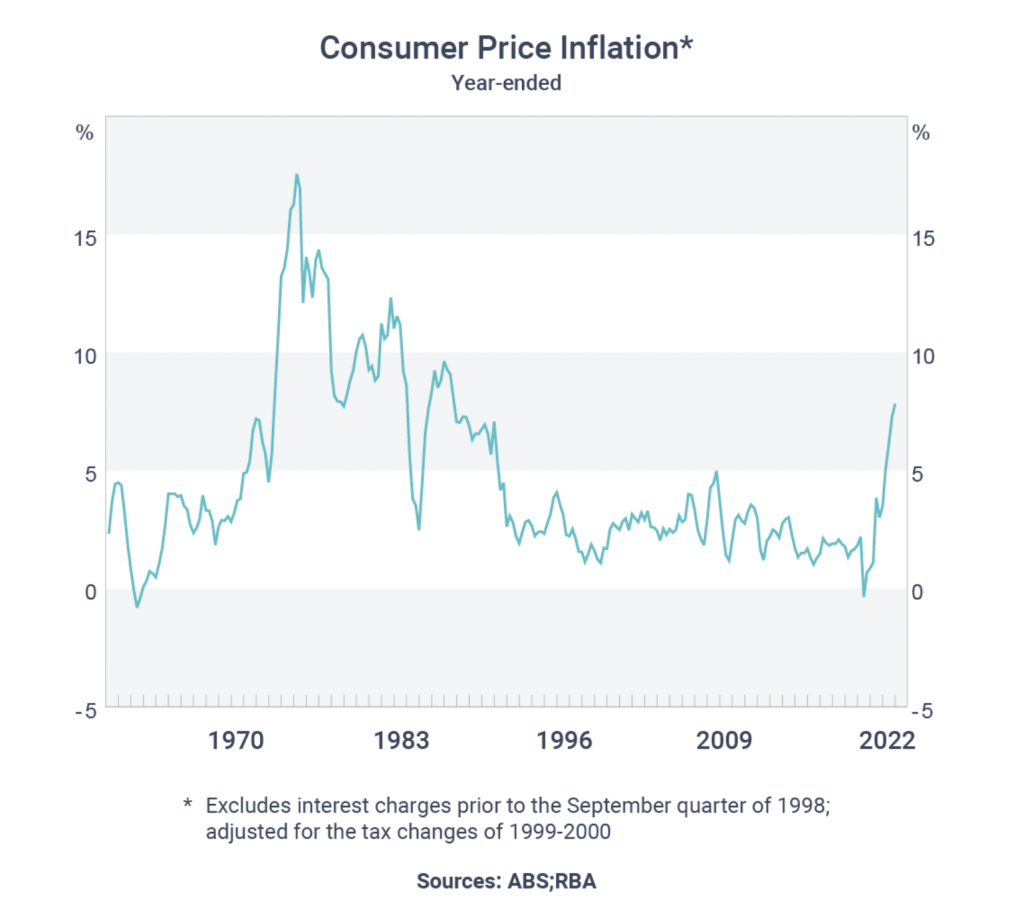

RBA may be closer to restricting rate hikes as interest rates skyrocket

Over the last month the Reserve Bank of Australia (RBA) governor Philip Lowe has made suggestions that with monetary policy now in “restrictive territory”, interest rates may be nearing their peak.

Delivering a speech the day after the RBA raised the cash rate for the 10th consecutive time, Governor Lowe stated that the RBA Board was closely monitoring the effect of the collective and consecutive earlier rate rises.

We discussed the lags in monetary policy, the effects of the large cumulative increase in interest rates since May and the difficulties that higher interest rates are causing for many households. We also discussed that, with monetary policy now in restrictive territory, we are closer to the point where it will be appropriate to pause interest rate increases to allow more time to assess the state of the economy.

RBA Governor – Philip Lowe

However, Governor Lowe maintained that inflation was still far too high and that a further tightening of monetary policy is likely to be required to tackle inflation within a reasonable timeframe.

The unfortunate reality that Mr Lowe described was that if our battle with inflation isn’t managed appropriately and if it does not come down soon, the outcome will be even higher interest rates and further unemployment.

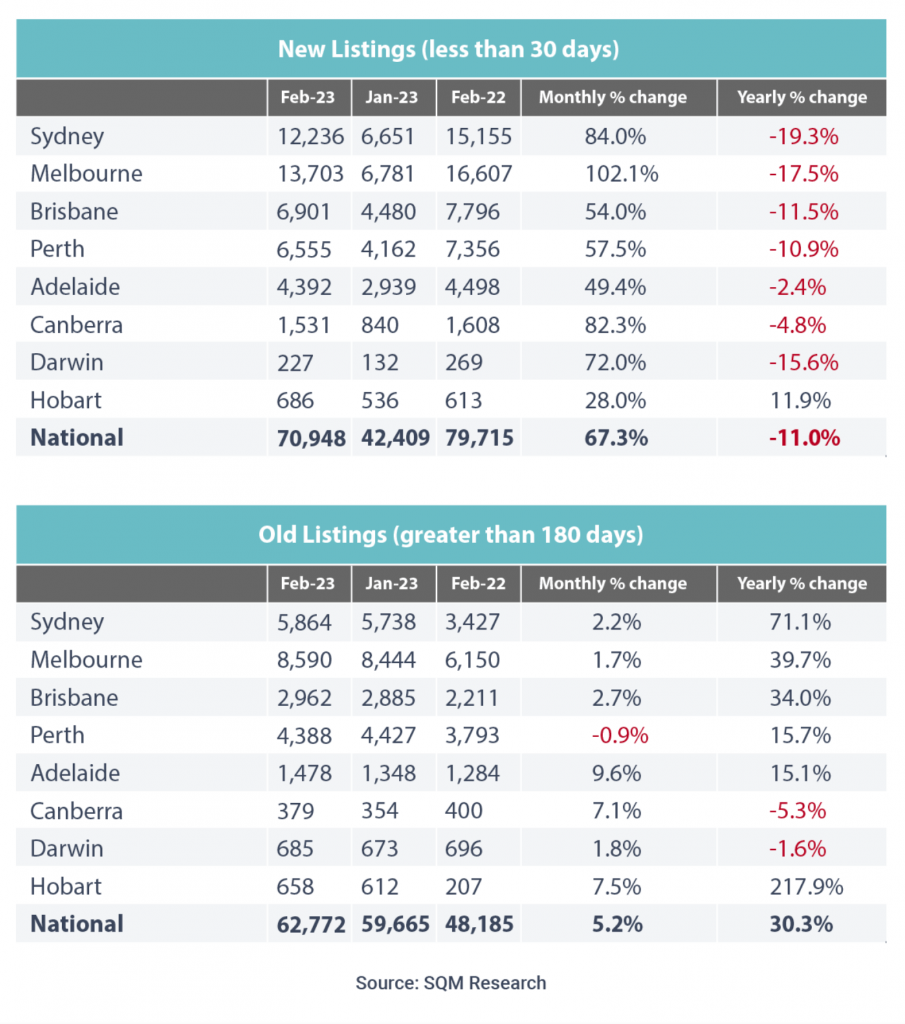

Home owners aren’t keen to list their properties for sale

The number of dwellings listed for sale has risen, although this is due to less new listings coming onto the market than current listings taking longer to sell.

Recent data from SQM Research has revealed that 231,039 properties across the country were listed for sale in February, a figure that was 7.7% higher than the year before.

Significantly, though, the number of new listings less than 30 days old in February was 11.0% lower than in 2022. On the other hand, the number of older listings greater than 180 days was 30.3% higher.

SQM managing director Louis Christopher explained that very few owners wanted to sell – or to set a price that met the current market expectations.

This clearly reveals itself by the lower-than-average counts of new stock entering the market for February and what sellers are there, continue to hold the line on their asking price.

But sellers do need to understand the market is unlikely to catch up to their asking price at this present point in time. Only a minority of sellers recognise this, hence why there has been a rather large rise in older listings.

Louis christopher – SQM Managing Director

If you’re looking to purchase a home while property prices are slowing, now may be a great time to review your options and see how much you can borrow. Work with our expert team at Rateseeker and we’ll help you access over 1000+ loan options from over 30+ lenders with the sharpest rates available.

** General Advice Warning

The information provided on this website is general in nature only and it does not take into account your personal needs or circumstances into consideration. Before acting on any advice, you should consider whether the information is appropriate to your needs and where appropriate, seek professional advice in relation to legal, financial, taxation, mortgage or other advice.