Rateseeker Business News Round-up July 2024

As we pass mid year and well into the colder months of winter, Australia’s business and finance landscape is seeing some significant developments that are essential for business owners and investors to consider.

Inflation has edged up to 4.0%, driven by rising costs in housing, food, and transport, adding pressure on operating expenses and influencing investment decisions. Meanwhile, the Australian Taxation Office (ATO) has released new tax advice, particularly around the instant asset write-off and small business energy incentives, providing valuable opportunities for businesses to manage their tax obligations more effectively in this high-cost environment.

At the same time, navigating the business loan market has become increasingly important. With interest rates still fluctuating, understanding the best options available can significantly impact your business’s financial health.

Additionally, there’s been a notable increase in electric vehicle (EV) sales, a trend that could have wide-reaching implications for businesses, especially those involved in logistics, fleet management, or green initiatives.

Staying informed as to market insights and being proactive in managing your business finances and investments are essential as the economic environment continues to evolve. Check out the latest updates below:

Behind Australia’s Inflation: The Role of Energy Costs and Volatile Prices

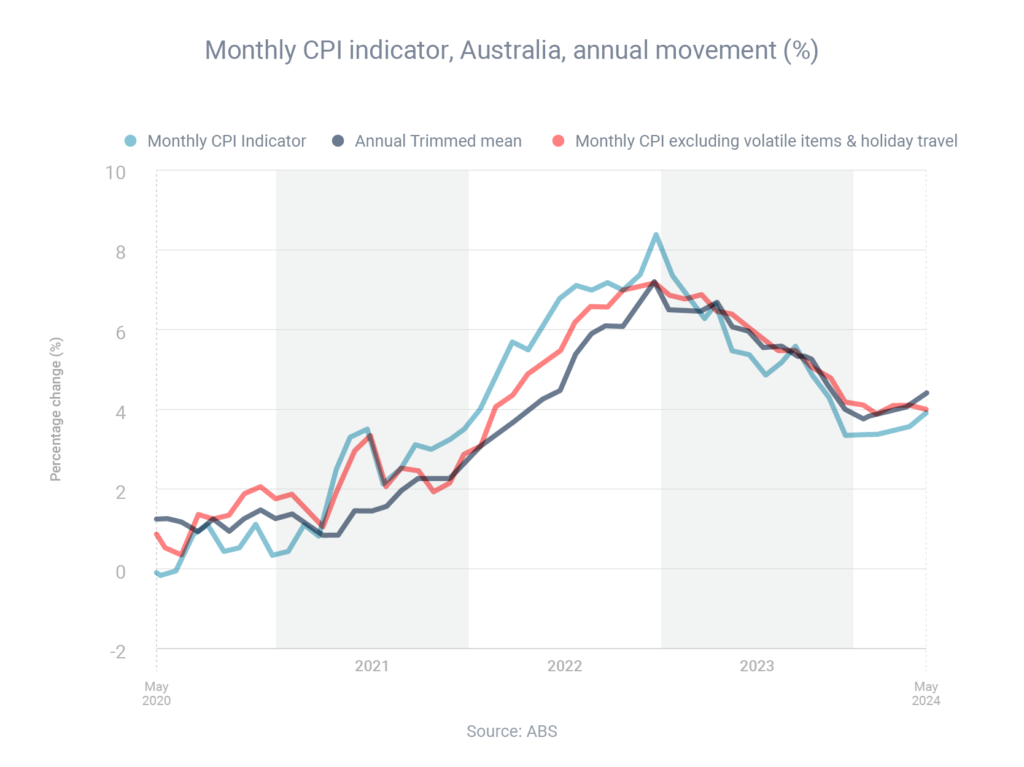

Australia continues to grapple with persistent inflationary pressures, as the consumer price index (CPI) rose to 4.0% in the year leading up to May 2024, according to the Australian Bureau of Statistics (ABS). This increase follows a 3.6% rise in April and, while it reflects a decline from the 5.5% recorded a year earlier, it highlights the ongoing challenges in stabilising prices.

The inflation landscape, however, is nuanced. Michelle Marquardt, the ABS’s head of prices statistics, notes that headline inflation is often influenced by volatile items such as petrol, holiday travel, and fresh produce. When these are excluded, underlying inflation remained at 4.0% in May—down slightly from 4.1% in April and significantly lower than the 6.4% observed the previous year.

A particularly concerning driver of inflation has been the sharp rise in electricity prices, which surged by 6.5% over the year to May, up from a 4.2% increase in April. The impact of these price hikes has been somewhat mitigated by the federal government’s Energy Bill Relief Fund, introduced in July 2023. This fund has provided critical rebates to households, softening the blow from annual electricity price reviews.

Although, as these rebates are gradually used up, out-of-pocket electricity costs are beginning to climb again. Marquardt pressed that without these rebates, electricity prices would have risen by a staggering 14.5% over the past year, highlighting the significant role government interventions have played in cushioning the impact on consumers.

This complex inflationary environment poses ongoing challenges for businesses and households alike. While the slight decline in underlying inflation offers some hope, the continued rise in essential costs like electricity suggests that inflationary pressures may persist, particularly as government relief measures phase out.

Staying on top of news and updates while being proactive in managing expenses will be crucial for navigating these turbulent economic waters for Aussie consumers.

How to Offset Capital Gains with Losses and Maximise Your Tax Savings

The Australian Taxation Office (ATO) has provided strategic advice for reducing capital gains tax (CGT) liabilities as businesses and individuals approach the end of the 2023-24 financial year. A key method to lower your CGT is by offsetting your capital gains with any capital losses you’ve incurred, either in the current year or from previous years. According to the ATO, it’s important to first utilise losses carried forward from prior years to reduce your current year’s capital gains. If these losses bring your taxable capital gains to zero, any remaining losses can be carried forward indefinitely to offset future gains.

The ATO also offers flexibility in how you apply these losses. You have the option to choose which capital gains to offset, but with a specific caveat: gains from collectables such as artwork, jewellery, and antiques can only be offset by losses from other collectables. To maximise your CGT reduction, it’s advisable to first offset gains that aren’t eligible for the CGT discount, thereby minimising your overall tax liability.

For companies, the ATO allows the deduction of previous net capital losses against capital gains in the 2023-24 financial year, provided the company remains in the same line of business or is still under substantially the same ownership and control. This provision is particularly beneficial for businesses seeking to manage their tax positions efficiently as they navigate the complexities of capital gains tax.

How a Broker Can Help You Navigate the Complex Business Loan Landscape

Maximising your company’s profitability and success hinges on your ability to secure the right loans with favourable terms at the optimal time. Several key factors influence your eligibility for a business loan and the terms you might be offered.

- First and foremost is the financial position of your business. Lenders will scrutinise your assets, liabilities, income, savings rate, and overall profitability, with a keen interest in whether these metrics are improving or declining over time.

- Additionally, the purpose of the loan is critical; a well-prepared business case can significantly boost lender confidence in your repayment capacity.

- Your credit history also plays a pivotal role. Lenders will assess how well you’ve managed past loans, with a particular focus on any late payments or defaults. While such issues can raise concerns, they are not necessarily deal-breakers if the rest of your application is strong.

- Other criteria, such as the specific requirements of different lenders, can also impact your loan application, making the process complex and challenging to navigate on your own.

Working with a knowledgeable broker or lending expert can greatly simplify the loan application process. Need an business loan and want to talk to an expert? Contact our team at Rateseeker, we have an in-depth understanding of the varying credit policies across many lenders, which allows us to guide you toward the most suitable loan options for your business needs. By leveraging our expertise, you can improve your chances of securing a loan that supports your company’s growth and financial stability.

Financing EV Options for a Greener Future

The shift toward electric vehicles (EVs) in Australia is gaining momentum, as evidenced by the latest figures from the Federal Chamber of Automotive Industries (FCAI). Of the 632,412 new vehicles sold in the year leading up to June 2024, a notable 50,219 were EVs—an impressive 16.5% increase from the previous year. This surge reflects growing consumer and business confidence in the viability and benefits of EVs. FCAI Chief Executive Tony Weber is optimistic about the future, expressing hopes of surpassing the significant milestone of 100,000 EV sales by the end of 2024.

When it comes to financing an EV, businesses and consumers have three main options:

- Visiting your regular bank

- Using dealer finance

- Consulting a specialist broker

However, each option comes with its own limitations. Approaching your bank might seem like the most straightforward route, but it limits your choices since banks will only promote their own products, potentially leaving better offers from other lenders off the table. Similarly, dealer finance can be restrictive, as car dealerships typically work with a limited number of lenders, meaning they won’t conduct a comprehensive market comparison for you.

To secure the best deal, consulting a specialist broker is often the most advantageous approach. Brokers have access to a wide range of lenders and can compare offers to find the most competitive rates and terms, ensuring that your switch to an EV is not only environmentally smart but also financially savvy.

If you’re looking to make a greener change in your next car purchase and need a loan, speak with our experienced loan specialists at Rateseeker today.

** General Advice Warning

The information provided on this website is general in nature only and it does not take into account your personal needs or circumstances into consideration. Before acting on any advice, you should consider whether the information is appropriate to your needs and where appropriate, seek professional advice in relation to legal, financial, taxation, mortgage or other advice.