Rateseeker August 2022 Property News Round-up

August has brought good news for Aussie home buyers with more choice in homes as listing numbers rise along with a welcome fall in fixed rates with some lenders passing on a rate cut to their customers.

Changes with the recent Climate Change Bill 2022 may have significant implications for Aussie real estate, should the bill be approved by Senate.

The ATO is also pleased to announce that more than 80 million pieces of information are available in pre-fill. With most Aussies tax-ready, now is a great time to get your return out of the way.

Missed the latest property news? Here are the biggest stories below.

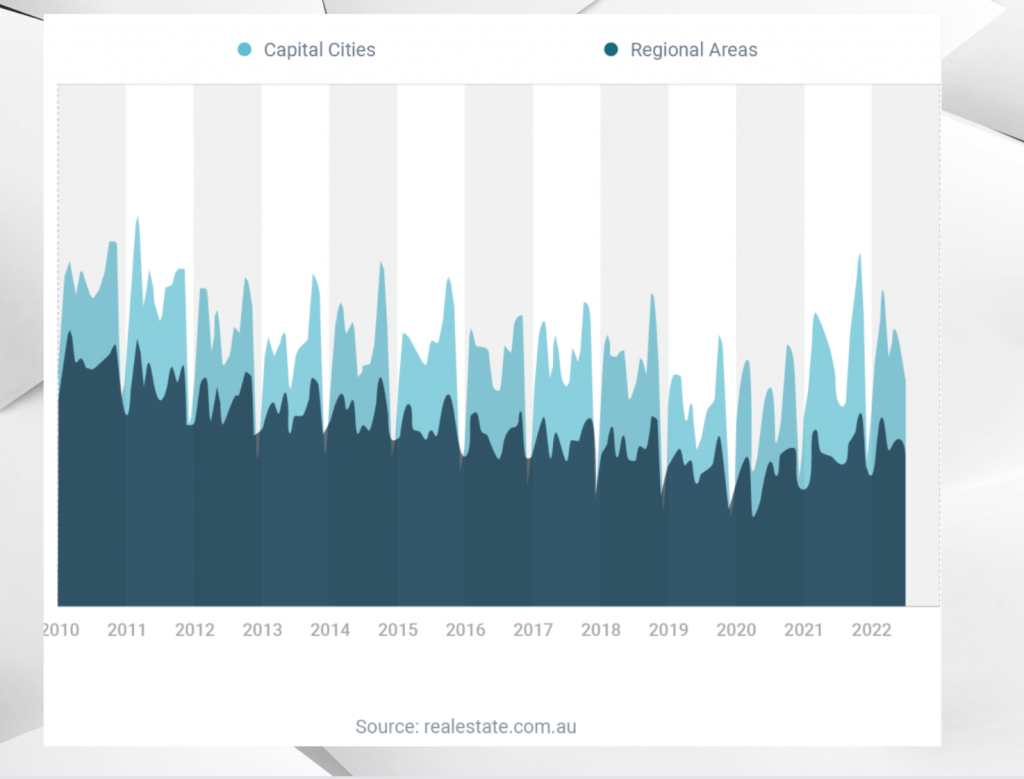

Aussie buyers enjoy more choice as listing numbers rise

Buyers across Australia can now enjoy a wider selection of housing options and more choice as the number of properties listed for sale across the country rises.

According to PropTrack , numbers of for-sale properties across the country in July jumped 0.6% higher than the previous month.

And in even better news, listings in July were 4.9% higher than the year before, which data reveals is the largest year-on-year increase since 2010.

In line with market cycles and varying conditions among the capitals cities:

- Hobart listings in July spiked 70.0% higher than the previous year

- Sydney increased by 30.7%

- Canberra increased by 24.8%

- Darwin increased by 14.4%

- Melbourne increased by 10.0%

- Perth increased by 4.6%

- Brisbane decreased by 0.7%

- Adelaide decreased by 3.6%

If you’re thinking about buying a property, it’s vital to seek pre-approval before you begin the searching process. Get in touch with us at Rateseeker, we can help un-complicate the process and help you find out how much you can borrow.

Why are some fixed rates falling?

In positive news, while variable interest rates across the board are continuing to rise, with experts predicting further increases, some lenders are actually cutting their fixed rates.

Various lenders have started increasing their variable rates since May, as the Reserve Bank of Australia (RBA) began deploying increases in their cash rate. However, some lenders have increased their fixed rates far earlier, as a pre-emptive measure in anticipation of future rate hikes.

Recent data from the RBA shows that interest rates for fixed loans:

- with terms greater than three years have been trending up since December 2020

- with terms of three years or less have been trending up since November 2021

Recently, some lenders have concluded that the RBA won’t be increasing the cash rate as much as they originally expected, and as a result, they feel some of their fixed rates were moved too high. This is why they’re now reversing course and making some welcomed reductions.

Unsure whether to go with a fixed loan, a variable loan or a split loan (which is part fixed and part variable)? Get in touch with our mortgage experts at Rateseeker and we’ll guide you through the pros and cons of each option.

The property industry is the next target for emissions reductions

The government’s brand new climate change legislation will have significant implications for Australian real estate, should it get approved by Senate.

Already approved by the House of Representatives, the Climate Change Bill 2022, will enshrine into law an hefty emissions reduction target of 43% from 2005 levels by 2030 and net zero emissions by 2050.

Hayden Groves, Real Estate Institute of Australia president, said that while the legislation does not specifically regulate residential real estate, he expects developers will pay more attention to energy efficiency measures and will also become more transparent about the energy efficiency of their buildings.

“And with that, the government hopes, so too will consumer preference and markets. Already, there is an emerging body of research that shows that homes demonstrating sustainable features currently command a premium.”

Hayden groves – President – Real estate institute of Australia

Mr Groves also added that the government had called its emissions reductions targets a “floor, not a ceiling”, which might be insight into further sustainability policies or investments in the future.

ATO encourages Australians to submit their tax returns now

Most taxpayers can now lodge their tax returns, as more than 80 million pieces of information are available in pre-fill.

The Australian Taxation Offie said much of the information it collects from employers, banks, private health insurers, share registries and other institutions has now been loaded into people’s tax returns.

“While having this data ready to go cuts down time, taxpayers still need to check that their details are accurate and ensure any other information that hasn’t been pre-filled is manually added,” according to the ATO.

– ATO

“For example, income from rentals, side hustles and the Pandemic Leave Disaster Payment from Services Australia will need to be manually added.”

Each employer will provide an income statement or payment summary that shows the amounts received and the tax withheld. If you had more than one employer during the 2021-22 financial year, you will have more than one income statement.

Before lodging, make sure your income statement is marked as ‘Tax ready’ by your employer.

Once you’ve lodged, you can monitor the progress of your tax return through ATO online services, the ATO app or by phone.

** General Advice Warning

The information provided on this website is general in nature only and it does not take into account your personal needs or circumstances into consideration. Before acting on any advice, you should consider whether the information is appropriate to your needs and where appropriate, seek professional advice in relation to legal, financial, taxation, mortgage or other advice.