November 2025 Market Update: Falling Mortgage Costs, Record Refinancing and a Wave of New Buyers Entering the Market

As we head toward the end of 2025, the property and finance landscape looks a little different from just a few months ago. Borrowers are feeling early relief from rate cuts, refinancing activity has hit new highs, and first home buyers now have more support than ever. At the same time, listings are surging while property prices continue to edge higher, creating an active and fast-moving market that rewards buyers who prepare early.

The Reserve Bank will announce its next cash rate decision on December 9, with no further cut expected yet. In the meantime, there are several key shifts worth keeping on your radar this month.

This newsletter breaks down what is happening, why it matters and how you can take advantage of current conditions before the new year.

Mortgage Costs Are Finally Falling and Borrowers Are Feeling the Relief

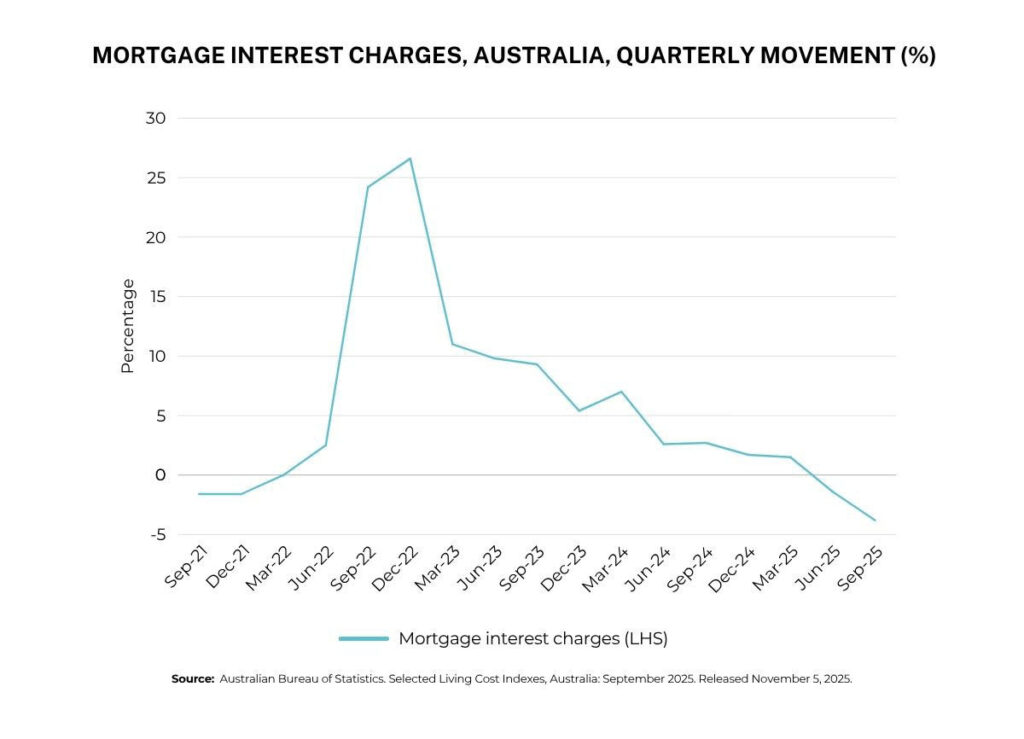

After two challenging years, homeowners are finally seeing their interest charges pull back. According to the Australian Bureau of Statistics, mortgage interest costs fell 1.4% in the June quarter and then dropped a further 3.8%in the September quarter. These reductions are a direct result of the three rate cuts delivered by the RBA earlier this year.

While these drops might look small on paper, they make a noticeable difference when spread across your mortgage repayments. Even a slight monthly saving can compound into thousands each year.

How Borrowers Are Using the Savings

Most households are not simply enjoying the extra breathing room. They are using it strategically.

Rebuilding their savings buffers

Many households prioritised survival during the tightening cycle. Now, they are rebuilding savings and strengthening their financial position.

Making extra repayments

With interest costs lower, borrowers are redirecting some of their savings back into their loans to reduce long-term interest and shorten their loan term.

Reviewing their loan competitively

Even though the RBA has cut rates, not all lenders have passed the reductions on evenly. There is now a wide gap between the cheapest and most expensive variable rates.

This is why it matters. You might already be benefiting from the rate cuts, but you could still be paying more than necessary if your lender has not repriced your loan competitively.

Avoiding the Lazy Tax

The lazy tax is the cost of staying on a loan that no longer reflects current market conditions. As lenders shift rapidly, many borrowers find themselves stuck on an uncompetitive rate simply because they have not reviewed their loan.

If you would like to check how your current rate compares to today’s market, I can provide a quick review and outline the potential savings from staying with your current lender, renegotiating or refinancing.

Record Refinancing Activity Shows There Are Big Savings to Be Claimed

More Australians are refinancing than ever before. External refinances in the September quarter jumped 25.2% compared with last year, reaching an all-time high according to ABS data.

This increase is not driven by restlessness or speculation. It is driven by genuine savings.

Rate cuts have created a highly competitive mortgage environment, but the competition is uneven. Some lenders have moved aggressively to win business, while others have made only minor price adjustments. As a result, two borrowers with the same loan size can now be paying noticeably different monthly amounts.

What Is Motivating Borrowers to Switch

Older fixed rates rolling off

Many borrowers are still transitioning from fixed periods set during the height of the tightening cycle. These borrowers are finding better options now that rates have eased.

Legacy variable rates priced above current conditions

If your loan is even a few years old, there is a strong chance your rate has drifted above market pricing.

Meaningful savings despite small rate movements

A drop of 0.30 to 0.50 percentage points can free up thousands per year in cash flow.

Three Refinancing Tips to Keep in Mind

- New to bank offers are often sharper. Lenders tend to offer their most aggressive pricing to new customers rather than loyal ones.

- Some deals move fast. In a shifting rate environment, special offers can come and go within weeks.

- Match your loan to your long-term goals. The cheapest rate is not always the best if it does not support your broader financial plans.

If you want to know how much you could save or which lenders suit your goals, I can compare the market for you and outline your options in a clear, personalised way.

The 5% Deposit Scheme Expansion Is Reshaping the First Home Buyer Landscape

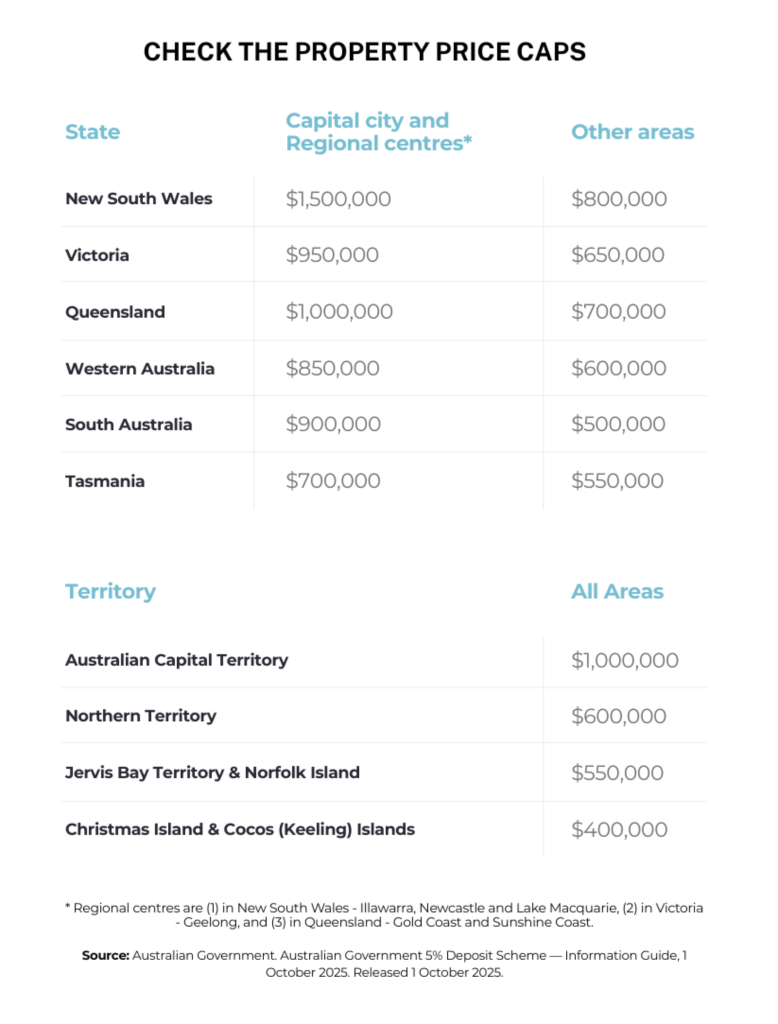

First home buyers received a major boost this year with significant changes to the 5% Deposit Scheme. As of 1 October, the scheme offers:

- Unlimited places

- No income caps

- Only a 5% deposit required

- No lenders mortgage insurance, provided the property is under its price cap

Price caps vary across the country, from $500,000 in regional South Australia to $1.5 million in Sydney.

This expansion is one of the most impactful policy changes in recent years, and it is already shifting behaviour in the market.

How the Scheme Is Changing Competition

Higher-earning couples can participate

Previously excluded buyers who earned slightly over the income limits can now enter the scheme and compete in more desirable areas.

More competition below cap thresholds

Suburbs priced just under their cap are seeing more interest, especially for townhouses and units.

Buyers are entering the market sooner

With small deposits required and LMI removed, many first-home buyers who expected to wait years are now purchasing earlier.

What Buyers Should Consider Before Using the Scheme

Even though the deposit hurdle has dropped, the long-term loan size will still be larger. This means repayment comfort, budget planning and buffers remain essential. The scheme is powerful, but it needs to be used responsibly.

If you want to confirm whether you are eligible or see what your repayments would look like under the scheme, I can run the numbers for you.

Listings Surge but Prices Continue to Climb

A sharp jump in new listings would normally slow the market. This time, the opposite has happened.

Australia’s median property price rose 1.1%in October, the strongest monthly increase since mid-2023. Prices are up 2.8% across the quarter, and every capital city recorded growth. Five capitals have reached new price highs.

At the same time, SQM Research reports:

- Total listings up 10.9%

- New listings up 18.2%

In most markets, this level of new supply would soften price momentum. Instead, strong demand is holding prices firm and in many cases pushing them higher.

Why This Is Happening

Rate cuts earlier this year have improved borrowing power and confidence. Even with more homes coming onto the market, demand is still running ahead of supply, especially for well-located and well-presented homes.

How Smart Buyers Are Approaching This Market

Getting pre-approval early

Being finance-ready allows buyers to act quickly when the right property appears.

Expanding their search radius

Neighbouring suburbs often offer better value and similar lifestyle amenities.

Stress testing their budget

Planning for slightly higher repayments is a smart way to protect long-term affordability.

If you want to prepare for a purchase or understand how much you can borrow, we can map out your borrowing power and compare lenders before you begin making offers.

Final Thoughts: A Strong Finish to 2025 and New Opportunities Ahead

With mortgage costs easing, refinancing at record levels and first home buyer support expanding, there is a significant shift happening across the property finance landscape.

Whether you are buying, refinancing or planning for 2026, now is a perfect time to review your loan, update your strategy and take advantage of the opportunities emerging in the market.

If you want to explore your borrowing position or compare your options before the holiday period, reach out, and we will walk through it together.Ready to plan your next move?

Contact Rateseeker now, and let’s take a look at your options and see what is possible.

** General Advice Warning

The information provided on this website is general in nature only and it does not take into account your personal needs or circumstances into consideration. Before acting on any advice, you should consider whether the information is appropriate to your needs and where appropriate, seek professional advice in relation to legal, financial, taxation, mortgage or other advice.