Rateseeker Round-Up: October Property News

Some big news has come out of the property market this October, as much of the country emerges from lockdown.

The APRA has tightened home loan rules for borrowers, while rental prices have soared due to increased tenant demand. At the same time, new data has emerged showing that buy-now-pay-later services have surged in recent years — a trend that may be affecting maximum borrowing power for Australians.

Missed the latest news from October? Catch up with the three biggest property market updates below.

APRA introduce new lending rules for interest rate buffers

Did you know that when you apply for a mortgage, lenders are required to assess your ability to repay the loan not on the actual interest rate, but on the interest rate plus a buffer?

This buffer is set by the Australian Prudential Regulation Authority (APRA) and was previously a minimum of 2.5%, which meant that if a home loan product was advertised with a 2% interest rate, a lender would assess your ability to service the loan based on an actual interest rate of 4.5% (2% interest rate + 2.5% buffer).

Now, thanks to new lending rules from the APRA, this buffer has increased to 3 percentage points.

So what does this mean for borrowers? The APRA expects this change will reduce the average person’s borrowing capacity by about 5%, which means a slight decrease in the maximum amount that you can borrow to purchase a home. However, these rules are expected to mainly affect investors, as many Australians don’t borrow the maximum amount.

In this new home loan environment, it’s never been more important to seek help from an expert broker who’s fully across the latest updates. Working with a broker will enable you to secure the sharpest rate possible for your home loan.

Ready to get started? Learn how much you can borrow now with an obligation-free consultation.

House rents grow 5.5%

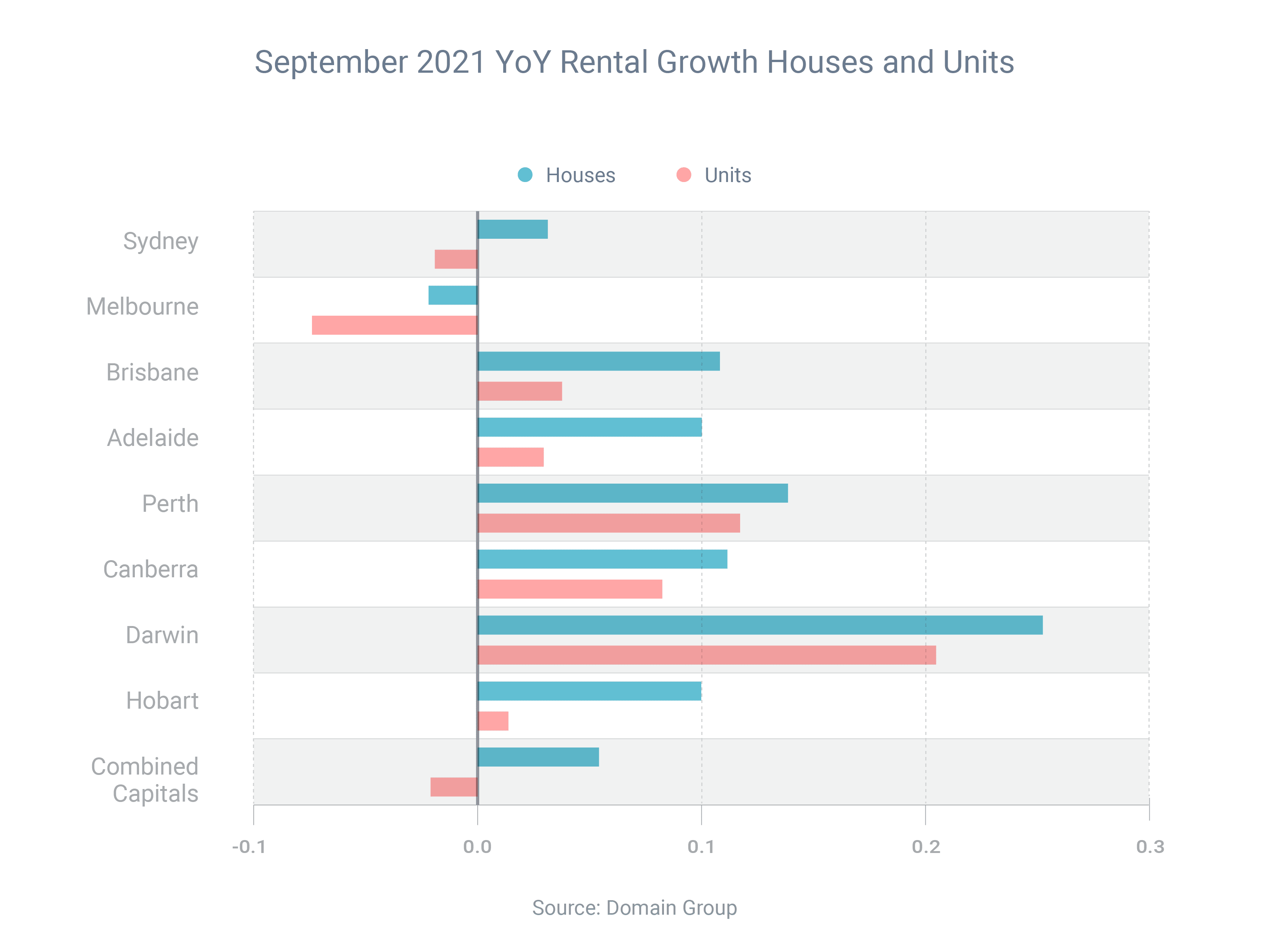

The latest report from Domain has found that capital city house rents have increased by an average of 5.5% over the year to September. What’s more, six capital cities have experienced double-digit growth in rental prices.

On the flip side, capital city unit rents decreased by an average of 2.1% over the same period. This is despite the fact that rents actually increased in every capital city except Melbourne.

The surge in rental prices across many parts of Australia is due to an undersupply of rental properties, which in turn has led to increased tenant demand for the limited amount of accommodation available.

This is also welcome news to property investors: with rents rising, prices rising and vacancy rates falling in many parts of the country, conditions are increasingly favouring landlords and those looking to enter the market.

If you’re looking for a home loan for an investment property, Rateseeker can help. Find out how much you can borrow and get started with our free online lending platform.

Buy now, pay later services may affect home loan chances

The use of buy-now-pay-later (BNPL) services has doubled between 2018 and 2021, according to Roy Morgan.

While these services do make it more convenient to make purchases and pay them off over time, our growing penchant for services like Afterpay and Zip Pay may impact our long-term ability to secure a loan. If you’re regularly using BNPL, lenders might think you’re struggling to manage your finances, and wonder how much they could safely afford to loan you.

The same goes for credit card services. If you have a credit card with a $10,000 limit, lenders will assume you will spend this amount each month – even if this is far from the truth. In turn, this will make it look like you have more debt and reduce the amount lenders are willing to loan you.

Lastly, be incredibly diligent about both your credit card and BNPL repayments. If you end up missing payments on either — or worse, both — lenders may be even less willing to approve you for the maximum amount of your borrowing capacity.

If you’re preparing to purchase a property, try these three tips to cut back on household debt:

- Reduce or eliminate your use of BNPL services and pay upfront instead

- Lower your credit card limit or cancel your card

- Make all your repayments on time

Looking to maximise your borrowing power? Talk to an expert and discover the best home loan option for your needs.

** General Advice Warning

The information provided on this website is general in nature only and it does not take into account your personal needs or circumstances into consideration. Before acting on any advice, you should consider whether the information is appropriate to your needs and where appropriate, seek professional advice in relation to legal, financial, taxation, mortgage or other advice.