Rateseeker Round-up: October Finance and Business News

Australia’s economy is on track to bounce back as we enter the last quarter of 2021. Small business subcontractors are now benefitting from faster payments on government contracts, while new data from the ABS has revealed the winners and losers of lockdown. On a more serious note, scam activity has also surged 89% last year, which has left businesses and individuals vulnerable to personal and financial losses.

Read the biggest updates from Australia’s finance and business sector below.

20-day payment rule takes effect

Small business subcontractors working on federal government contracts should now be receiving faster payments as a result of the Payment Times Procurement Connected Policy. This policy, which took effect on October 1, states that big businesses with federal contracts must pay their subcontractors within 20 calendar days.

If the business takes longer than 20 days to make a payment, it must pay interest on the unpaid portion of the invoice. This is provided that the subcontractor meets all of their responsibilities as well: they must do a satisfactory job and submit a proper invoice.

New report reveals JobKeeper saved Australia from economic disaster

The introduction of JobKeeper spared Australia from significant economic pain by supporting 4 million Australians and 1 million businesses during its first six months, according to a new report from the Federal Treasury.

Between February and July 2020, the unemployment rate jumped from 5.1% to 7.4%, while the economy contracted 0.3% in the March quarter and 7.0% in the June quarter. However, without JobKeeper, the report estimated that the peak of the unemployment rate would have been at least 5 percentage points higher.

“Without the support provided by JobKeeper and other measures, many individuals could have faced extended periods of unemployment. And many businesses that recovered – even those that recovered quickly – may not have been able to do so.”

ABS data reveals winners and losers from lockdown

New data from the Australian Bureau of Statistics (ABS) has revealed the winners and losers from the nation’s widespread lockdowns in July and August.

Unsurprisingly, accommodation & food services suffered the biggest fall with a 16.6% month-on-month decline in turnover in July and a further 6.5% decline in August. Construction and other services were the only other two sectors to record declines over this period.

On the flipside, Australia’s mining sector increased turnover by 4.6% in July. Turnover remained almost unchanged in August at 0.1%. Manufacturing (1.2% and 0.9%) and wholesale trade (0.6% and 1.0%) also expanded in both months.

Looking to finish the year off strong? Reach out to us today to see if business finance is right for your company.

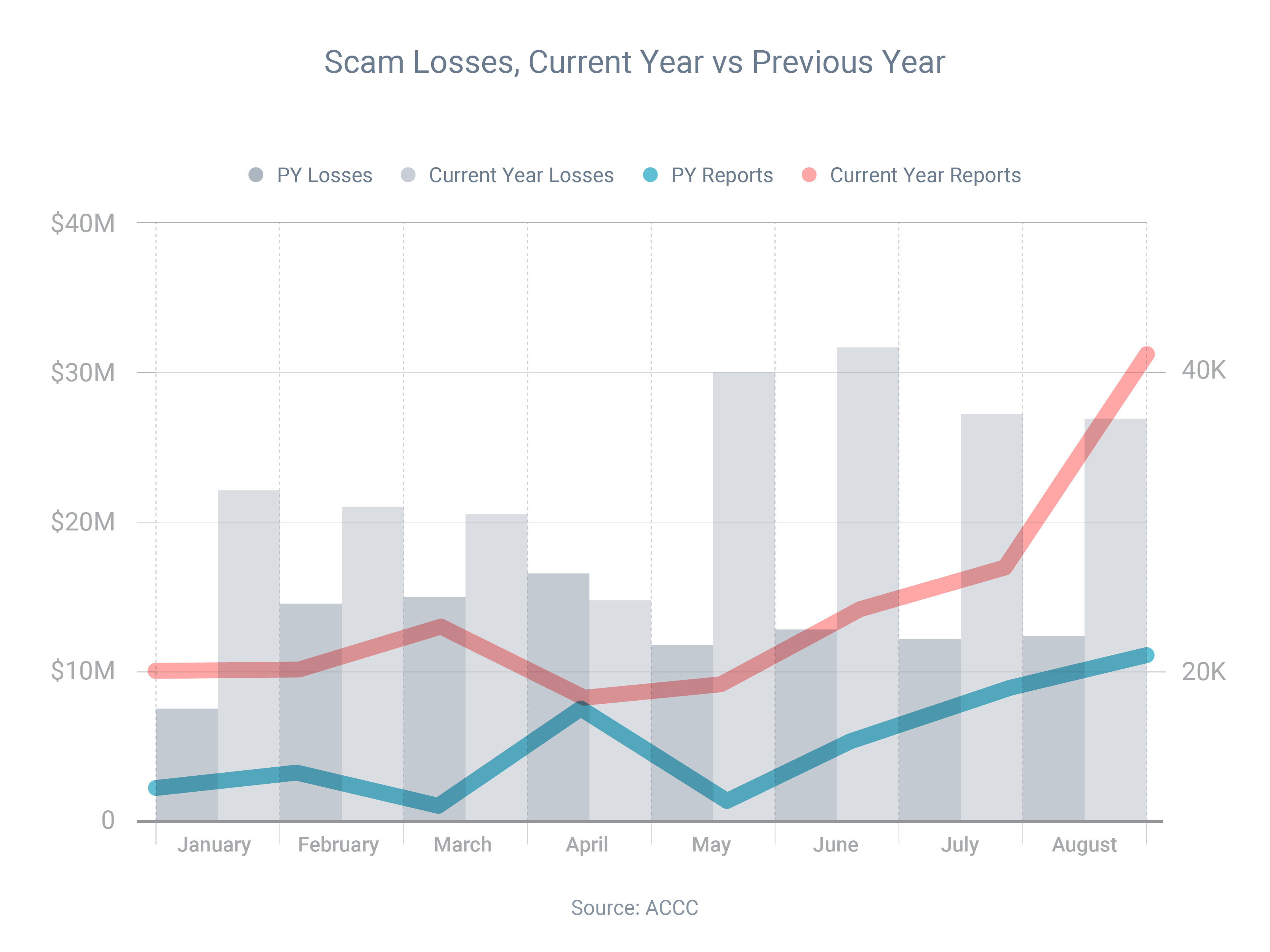

ACCC reports massive increase in scam activity this year

Australia’s consumer watchdog has reported a whopping 89% increase in scam activity for the period between 1 January and 19 September 2021, when compared to the same period last year.

That translates to roughly $211 million in losses to scams across the country. At an individual level, the average loss so far this year is about $11,000, compared to $7,000 the year before.

While scam activity is picking up across the board, the ACCC says phone scams are “exploding”, with Australians filing 113,000 reports about this type of crime. There has also been a significant increase in losses to phishing scams, remote access scams and identity theft.

For more information on how to protect yourself from scams, visit the Scamwatch website.

** General Advice Warning

The information provided on this website is general in nature only and it does not take into account your personal needs or circumstances into consideration. Before acting on any advice, you should consider whether the information is appropriate to your needs and where appropriate, seek professional advice in relation to legal, financial, taxation, mortgage or other advice.