Rateseeker Round-up: November Property News

2021 is winding to a close, but that hasn’t stopped the property market.

November was another busy month, with investor activity surging across the country and existing homeowners scoring better deals on their mortgages with refinancing. On the interest rate front, new research has also emerged showing that property prices may continue to go up, even if the RBA cash rate increases.

Missed the news? We have you covered. Here are the top four stories you should know about from the past month.

Australia experiencing a building boom

The number of new dwelling completions has increased significantly over the past five years, according to new data released by the Australian Bureau of Statistics (ABS).

Australians built just over 1 million homes between the 2016 and 2021 financial years – a massive increase on the long-term average, which has hovered around 750,000 during each five-year period.

So what’s driving the boom?

Experts believe it’s a combination of low interest rates for construction loans, coupled with new government incentives that have been introduced in recent years.

What’s more, this pace doesn’t seem like it’s going to let up in the foreseeable future: In the past 12 months alone 231,816 residential building approvals have been issued, which suggests even more new homes are in the pipeline.

Thinking of building a home? Construction loans are different from regular loans, and can be tricky to navigate for new borrowers. If you need help with financing your new build, get in touch with us now.

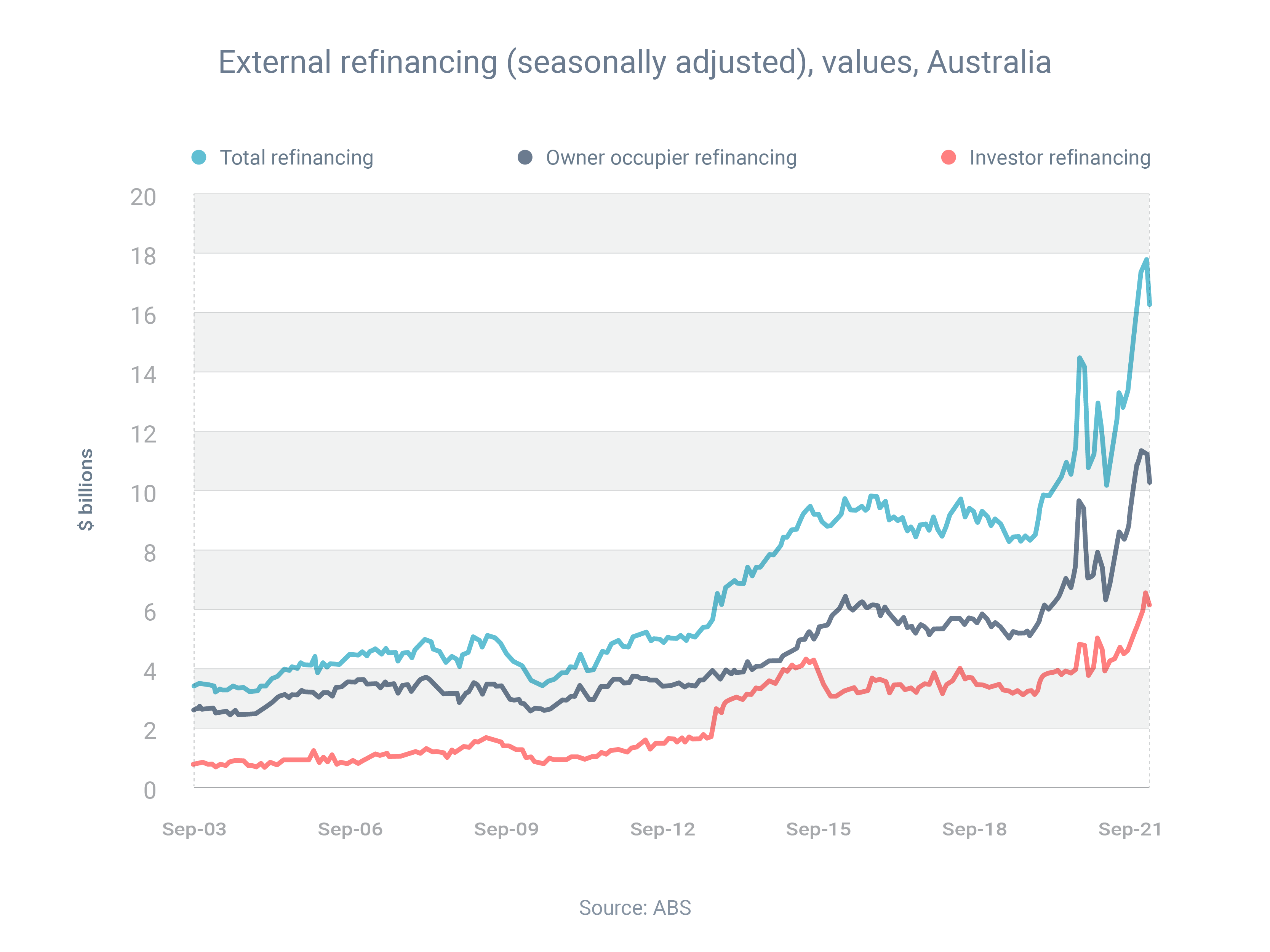

Refinancing activity reaches near-record levels

ABS data shows that a growing number of borrowers are choosing to refinance their homes, with refinancing activity at near-record levels across the country.

This uptick in refinancing activity comes amidst speculation that the Reserve Bank of Australia (RBA) will increase the cash rate in 2023 or even 2022. All of the big four banks have also increased their fixed rates in recent weeks, which might be causing some more borrowers to consider refinancing.

Refinancing is a fantastic way to secure a sharper rate on your home loan; however, it does come with its fair share of costs. If you’re thinking about refinancing, it’s best to consult a mortgage broker first to see if it’s the right move for your personal and financial situation.

Property prices can increase even once the cash rate rises, analysts find

The RBA hasn’t increased the cash rate in over 130 consecutive months – and for the past year, the cash rate has been at a record-low 0.1%, with the Reserve Bank using ultra-low interest rates as a way to stimulate the economy during the COVID-19 pandemic.

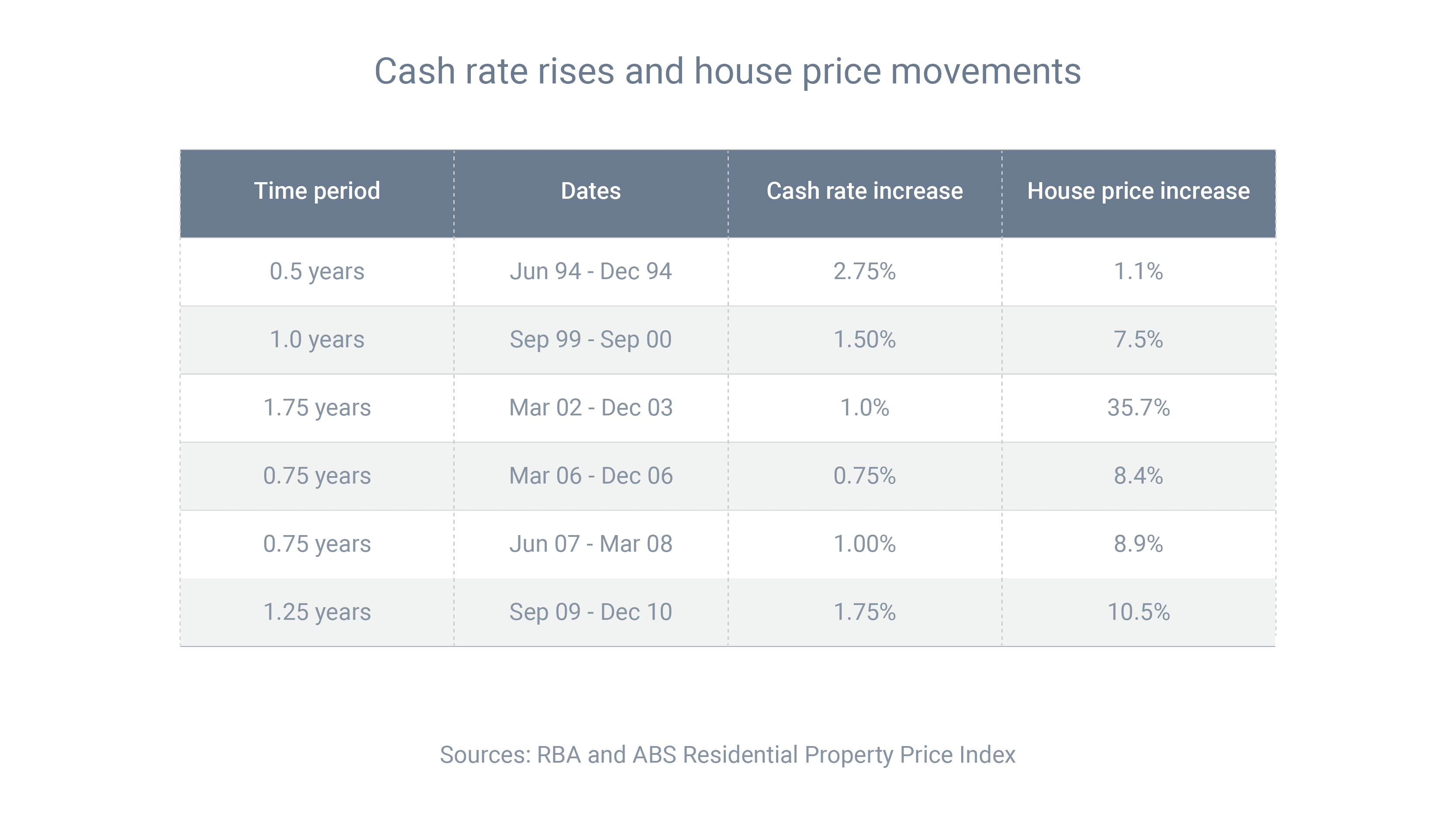

With a rise tipped for 2022 or 2023, most people expect that property prices will level out or even lead to a downturn in the market. However, this isn’t always the case according to research by the Property Investment Professionals of Australia (PIPA).

PIPA analysis of five periods of increasing cash rate movements since 1994 found that property prices continued to rise even after rate increases of up 2.75 percentage points:

Investor borrowing continues to rise

Investor borrowing has increased for 11 consecutive months, from $5.1 billion in October 2020 to $9.6 billion in September 2021. This marks an increase of 87.5%, according to data from the ABS.

In addition to increasing month-on-month, September’s figure was also the second-largest month for investors in history. This is because a number of investors are entering the market right now due to the rare trifecta of rising prices, rising rents and falling vacancy rates.

Looking to get onto the property investment market? It’s important to know your numbers and put a plan in place well before you start searching for a property. Talk to us today to learn about your options for investing.

** General Advice Warning

The information provided on this website is general in nature only and it does not take into account your personal needs or circumstances into consideration. Before acting on any advice, you should consider whether the information is appropriate to your needs and where appropriate, seek professional advice in relation to legal, financial, taxation, mortgage or other advice.