Rateseeker Round-up: July Property News

July was a busy month for the property sector. With COVID-19 restrictions in place across much of the country, lenders introduced new relief measures to help struggling homeowners. In other updates, new findings have indicated that buying a home is cheaper than renting for many properties across Australia, and property investors are collecting more rental income as rent prices surged in 2021-21.

Want to discover the latest news in the property market? Check out the biggest updates from July below.

Lenders offer home loan relief to struggling borrowers

As capital cities returned to lockdown over the past few weeks, lenders have offered home loan relief to affected borrowers. These measures are similar to those introduced in 2020 when the COVID-19 pandemic first hit Australian shores:

Depending on the circumstance, some homeowners may be eligible for deferrals on their mortgage repayments. All borrowers can apply for a mortgage pause with their lender, regardless of where they are situated or the industry they are employed in. These applications are being decided on a case-by-case basis, with successful deferrals granted on a month-by-month basis.

“Customers can rest assured that if they need help, they will get it. Your bank will help you find a way through, don’t tough it out on your own.”

Australian Banking Association

Interested in learning more? Discover the COVID-19 support measures on offer in 2021.

New analysis shows that owning property is cheaper than renting

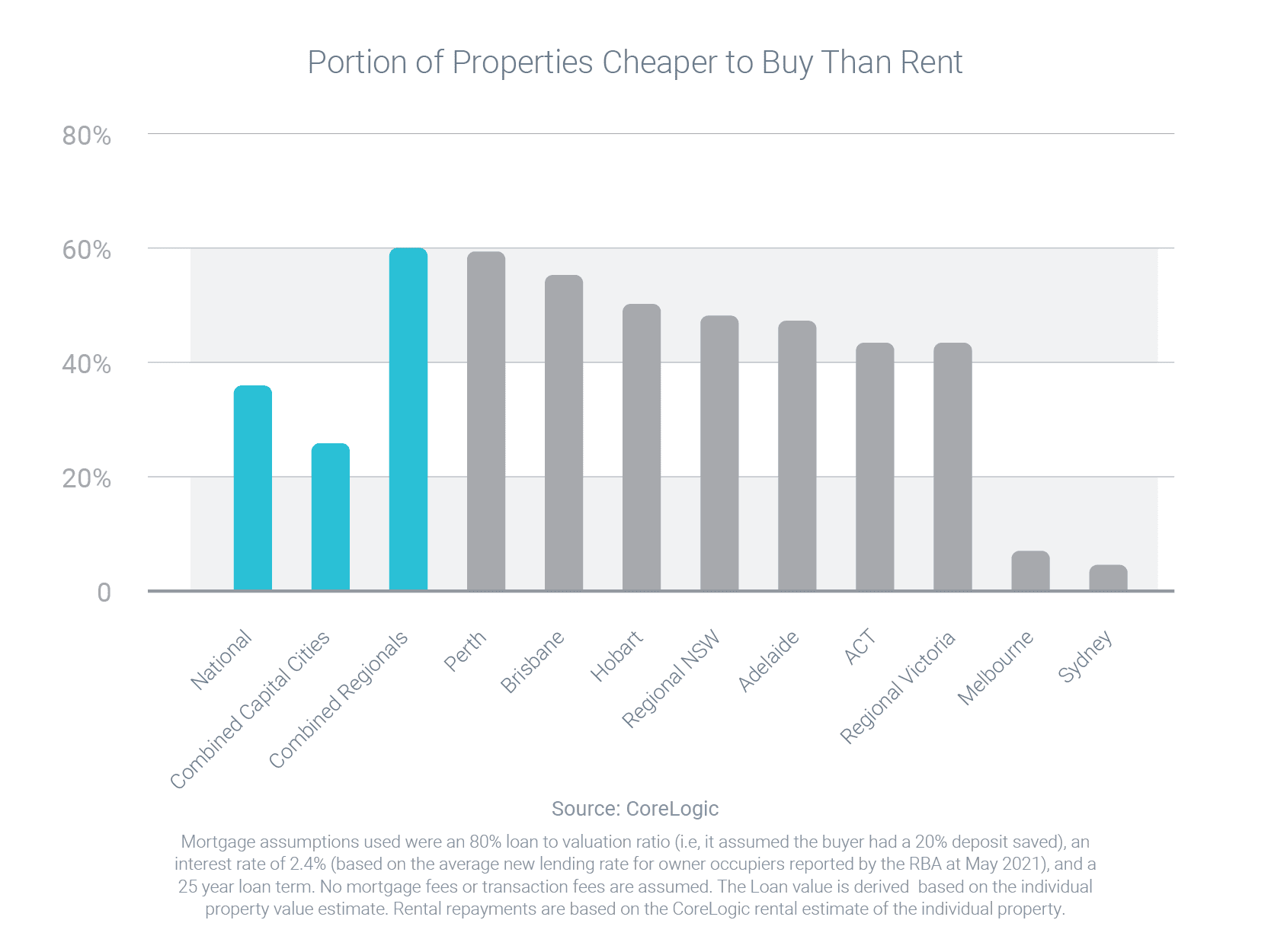

New analysis from CoreLogic has found that buying property is cheaper than renting for more than a third of homes (36.3%) across Australia. This means that it takes less money for property owners to meet ongoing mortgage repayments than ongoing rental payments, based on a 20% deposit and 25-year loan with a mortgage rate of 2.40%.

This figure has gone up by nearly three percentage points since February 2020, where it was cheaper to buy than rent 33.9% of homes. However, the number varies significantly between states: for example, it’s much cheaper to buy in the majority of regional locations but only in a minority in metro locations (28.2%).

Property investors benefit from more rental income

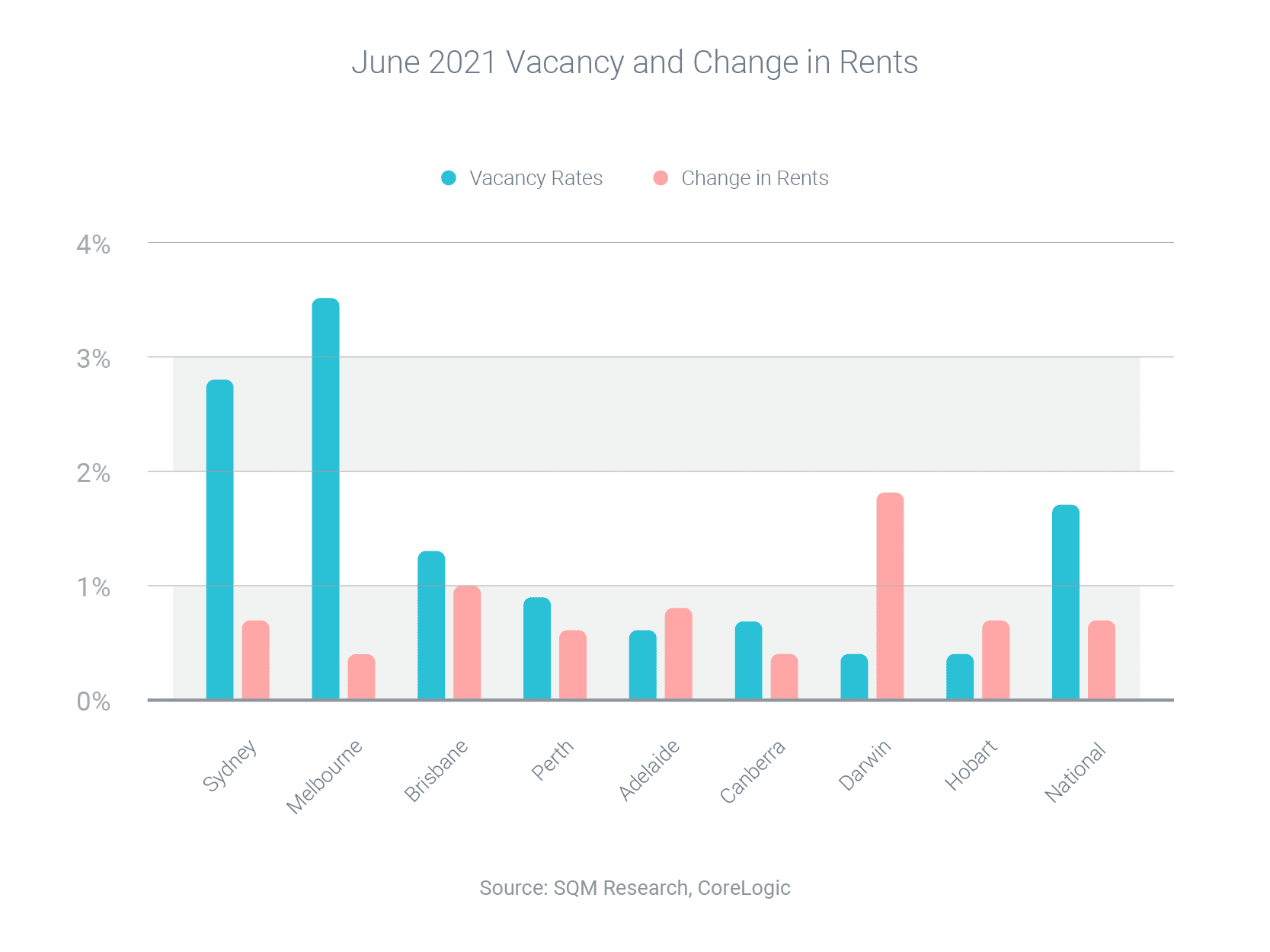

New data from SQM Research has shown that between June 2020 and June 2021, the vacancy rate of rental properties fell in almost every capital city except Melbourne.

The harder it is for tenants to find accommodation, the easier it is for landlords to raise rents. As such, rent prices mirrored this trend, with CoreLogic reporting that rents rose between June 2020 and June 2021 in every capital city except Melbourne.

With vacancy rates on the decline and rental incomes on the increase, it’s no surprise that now is the perfect time to purchase an investment property. If you’re looking to secure a loan for a rental home, get in touch with our mortgage brokers today and we’ll help you find the sharpest rate for your home loan.

** General Advice Warning

The information provided on this website is general in nature only and it does not take into account your personal needs or circumstances into consideration. Before acting on any advice, you should consider whether the information is appropriate to your needs and where appropriate, seek professional advice in relation to legal, financial, taxation, mortgage or other advice.