Rateseeker Round-up: January Finance and Business News

Many Australian businesses struggled to get their foot off the ground at the beginning of the year as Omicron hit the country hard and created labour shortages across the country.

However, there is a silver lining: in January, the government announced it would be providing funding for mental health programs for small businesses who need coaching or support. This is a welcome move for many SMEs who have been doing it tough and may be struggling with personal and financial issues in the wake of the pandemic.

In other business news, 4 in 10 Aussies are now working from home, which shows that the ‘new normal’ predicted in 2020 is definitely here to stay. Demand for commercial vehicles and construction loans has also surged in 2021.

Want to learn more? Catch up on the biggest updates from January below.

Federal Government commits $7.6 million for small business support

The federal government has increased its funding for two free mental health support programs dedicated to small business owners: the NewAccess for Small Business Owners program by Beyond Blue and the Small Business Debt Helpline by Financial Counselling Australia. This additional funding comes after its earlier commitment for $7.8 million.

NewAccess for Small Business Owners provides free, confidential, one-on-one mental health support via phone or video to small business owners, including sole traders. The coaches are former small business owners, so they understand the challenges that entrepreneurs face, including family and financial pressures.

The Small Business Debt Helpline is a free service for small business owners in financial difficulty. It helps owners manage difficult issues, including avoiding bankruptcy, negotiating payment plans, debt waivers, grant applications and insolvency.

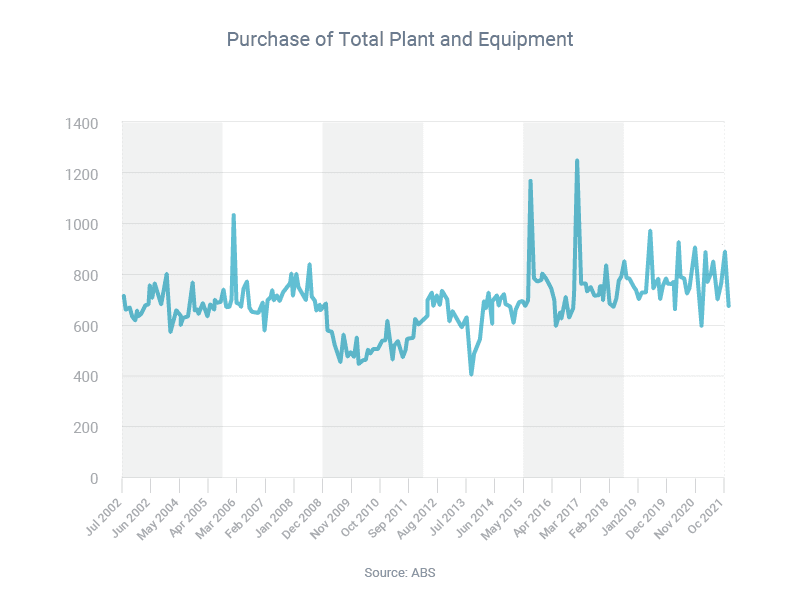

Businesses borrowing more for construction purposes in 2021

Businesses took out $26.9 billion of loans in the year to November 2021, according to new data from the Australian Bureau of Statistics. This is a 2.9% increase in the $26.1 billion of loans in the previous 12 months.

At the same time, companies have also slightly pulled back on purchases for plant and equipment. Businesses of all sizes took out $9.21 billion of loans to buy plant and equipment in the year to November 2021, which was 2.0% less than the $9.40 billion of loans in the year before.

Getting a business loan can be challenging, as different lenders operate by very different lending rules. If you’re looking to secure a business loan, it’s best to work with an expert broker from the Rateseeker team. We can match you with a lender that’s likely to look favourably on a business with your particular profile, and help you grow your business in 2022.

Contact us today for an obligation-free consultation.

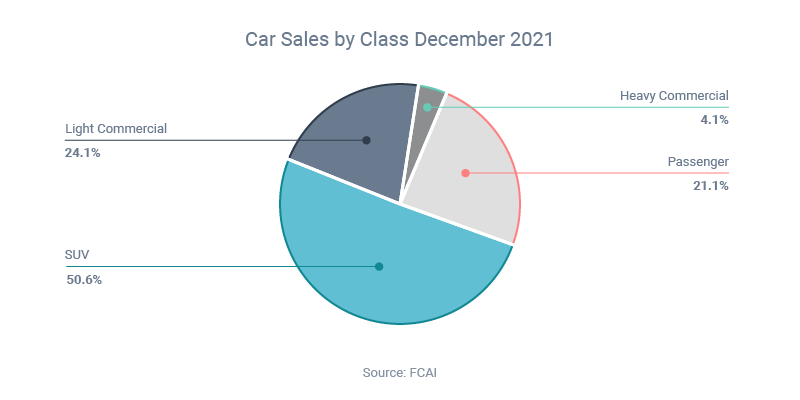

Growing demand for SUVs and light commercial vehicles

Australian businesses and consumers purchased 1.05 million vehicles in 2021, according to the Federal Chamber of Automotive Industries. This was a 14.5% increase on the year before, with the surge largely driven by SUVs (up 16.9% on the previous year) and light commercial vehicles (up 23.2%). Sales for passenger vehicles dipped slightly by 0.2%.

Toyota was the most popular brand, capturing 21.3% of sales in 2021. Next came Mazda with 9.6% market share, Hyundai with 6.9%, Ford with 6.8% and Kia with 6.5%.

40% of Australians are now working from home

COVID-19 forced teams to work remotely from home, but it seems like this trend will be here to stay even once the pandemic ends. The most recent data from the Australian Bureau of Statistics (ABS) shows 40.6% of workers were regularly working from home during August 2021, when Sydney, Melbourne and other parts of Australia were in lockdown.

This is an increase compared to previous years, where less than a third of Aussies were working from home:

- August 2019 = 32.2%

- August 2017 = 30.9%

- August 2015 = 29.8%

** General Advice Warning

The information provided on this website is general in nature only and it does not take into account your personal needs or circumstances into consideration. Before acting on any advice, you should consider whether the information is appropriate to your needs and where appropriate, seek professional advice in relation to legal, financial, taxation, mortgage or other advice.