Rateseeker Round-Up: April Residential Property Market Updates

From HomeBuilder construction commencement extensions to falling electricity prices, there was plenty of news in the market this April.

Being aware of the latest property updates is a surefire way to secure a better deal on your home loan, or take advantage of the latest incentives and schemes.

In this post, we’ve rounded up the biggest updates to the residential property market that you should be aware of.

3 tips to secure a sharp home loan in a red-hot property market

Mortgage lending is at historically high levels, according to the most recent data from the Australian Bureau of Statistics. In February, Australians took out a massive $28.6 billion home loans in February, which is 1.8% lower than the month before but a massive 55.2% higher than the same time last year.

With the rising demand for home loans, lenders are tightening up their lending criteria and application processing times have gone through the roof. If you’re looking to secure a home loan in this climate, here are a few tips:

- Start early and expect delays, as lenders are taking longer than usual to process applications

- Shop around, as there are a number of great deals that aren’t necessarily being advertised to the market or shown on comparison websites

- Try to maintain a high credit rating and fix any blemishes you have (such as outstanding debt)

Here’s the good news: if you’re working with a mortgage broker, you’ll be covered in all three areas.

A broker has access to over 30 different lenders in their lending panel, including home loans that may not be publicly advertised. They can also advise you on how to best maintain (or improve) your credit rating, and ensure the home loan application process progresses smoothly.

Want to secure the sharpest home loan rate in this environment? We can help. Contact us today for an obligation-free consultation.

Both borrowers and banks are in good health

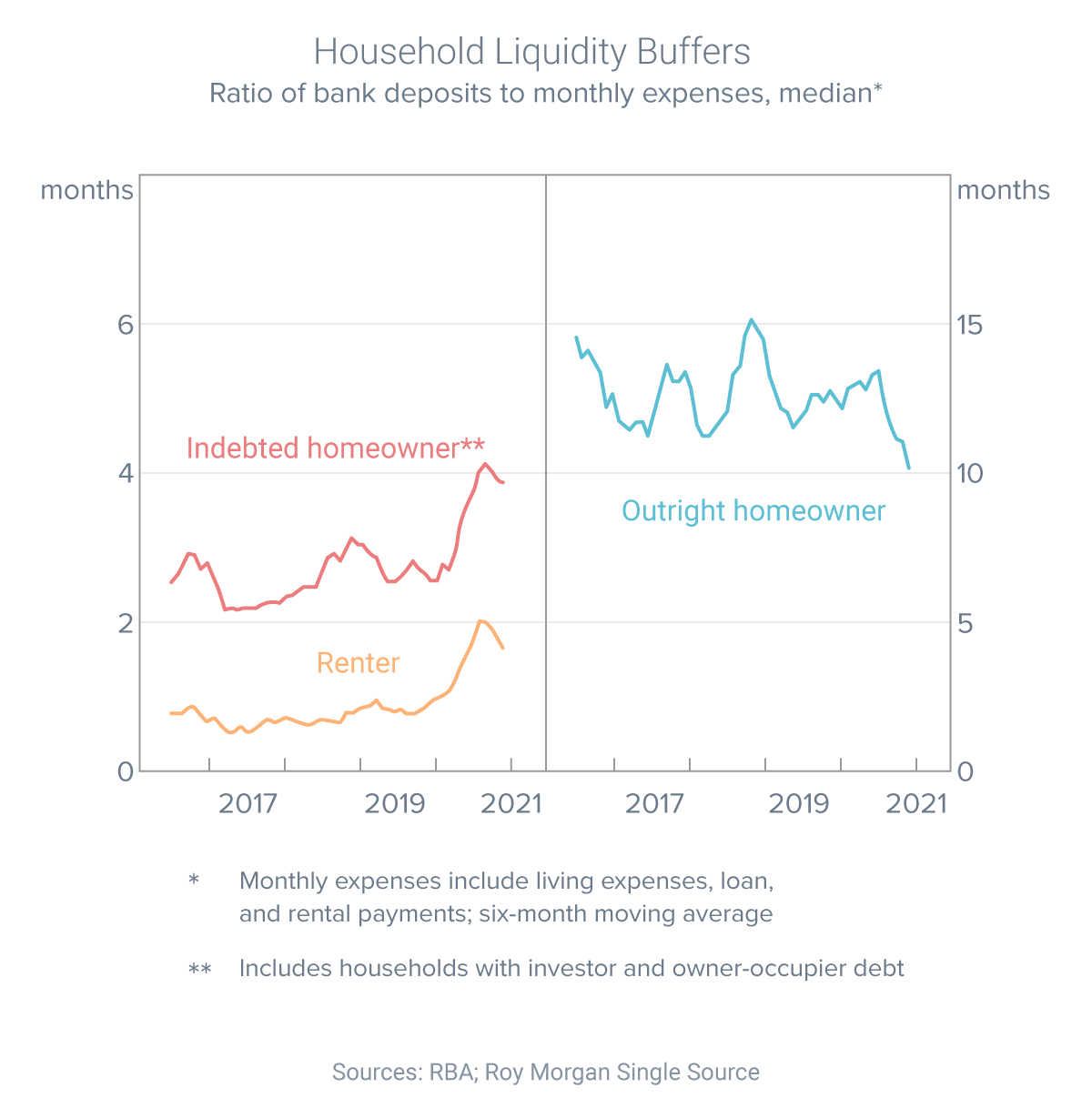

The Reserve Bank of Australia reported that indebted homeowners now have an average of four months worth of expenses in the bank. For comparison, renters have less than two months worth of expenses in the bank, and people who own their home outright have more than 10 months of expenses.

What’s more, the average household doubled their savings rate last year. Australians are now saving 12% of their income on average, and using this to reduce debt or increase their financial buffer in the event of an emergency.

Couple this with the fact that lending standards remain relatively unchanged, and borrowers are in a great position to buy their first (or next) property.

Extension on HomeBuilder construction commencement period

The government has increased the construction commencement period for the HomeBuilder grant from six to 18 months, due to unanticipated delays in the industry due to COVID-19.

If you were one of the 121,000 people who took advantage of the grant and signed a contract between 4 June 2020 and 31 March 2021, you’ll automatically benefit from this extension.

Falling power prices could see households save $126/year

According to the ACCC, electricity prices have fallen almost 9% since the middle of last year. This dip means that households in Australia’s eastern and southern states could benefit from significant potential savings.

Retail electricity offers in NSW, Victoria, south-east Queensland, SA and the ACT are on average 8.8% lower than June 2020, which translates to an average household saving of $126 per year. What’s more, wholesale electricity costs have fallen thanks to an increase in renewable energy generation and decreasing fuel costs – and retailers are required to pass on these cuts to consumers.

If you haven’t done so already, it’s time to shop around and see if you can secure a better deal on your electricity. You can use one of the tools below to compare offers:

- NSW, QLD, SA, TAS, ACT: Energy Made Easy

- VIC: Victorian Energy Compare

Need assistance with finance? Get in touch with the Rateseeker team today.

** General Advice Warning

The information provided on this website is general in nature only and it does not take into account your personal needs or circumstances into consideration. Before acting on any advice, you should consider whether the information is appropriate to your needs and where appropriate, seek professional advice in relation to legal, financial, taxation, mortgage or other advice.