Rateseeker Round-up: December Finance and Business News

With January in full swing, most workers are back on deck and ready to tackle the year ahead. However, the Omicron outbreak has continued to challenge Australian businesses across the board, with ongoing staff shortages and supply chain struggles.

If you’re preparing your company for the next 12 months, it pays to be aware of the biggest finance and business movements from 2021. With this in mind, here are four important updates from December to help guide your planning for 2022.

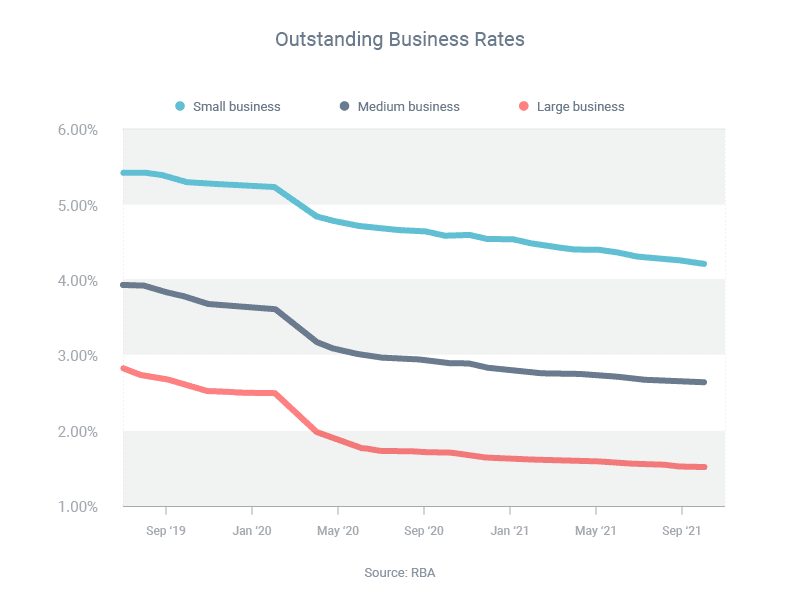

Falling interest rates for business loans in 2021

According to the Reserve Bank of Australia (RBA), interest rates for business loans have been trending down over the past year. The most recent data between September 2020 and September 2021 shows that average interest rates have fallen:

- 0.38 percentage points for small businesses

- 0.27 percentage points for medium businesses

- 0.19 percentage points for large businesses

On top of this, the data also reveals that new borrowers are benefitting from significant discounts on their loan. Over the course of 12 months, new borrowers were getting average discounts of:

- 0.91 percentage points for small businesses

- 0.21 percentage points for medium businesses

- 0.20 percentage points for large businesses

As we move into 2022, it’s a good time to revisit your loan and try to secure a better interest rate from a new lender. Get in touch with us today to see what’s available for your business.

Businesses enjoy growth despite COVID-19 pandemic

The latest data from the Australian Bureau of Statistics (ABS) shows that businesses have enjoyed solid growth in gross operating profits over the past 18 months, despite the effects of the COVID-19 pandemic.

The average company’s gross operating profit saw year-on-year increases of:

- Jun 2020 quarter = 12.9%

- Sep 2020 quarter = 18.5%

- Dec 2020 quarter = 15.2%

- Mar 2021 quarter = 11.7%

- Jun 2021 quarter = 5.4%

- Sep 2021 quarter = 5.4%

One of the key reasons behind these positive numbers is the ongoing stimulus packages provided by the Federal and State governments, as well as constraints in wage growth, with wages increasing just 2.2% over the year to September.

Businesses are also optimistic about the future: recent Roy Morgan research found that almost half (49.7%) of businesses expect to be in better financial shape this time next year.

Government eases visa rules for highly skilled migrants

In welcome news for many businesses, the Federal Government has improved access to permanent residence for highly skilled migrants working in critical sectors.

These changes apply to approximately 20,000 workers who are currently in Australia under the following visas:

- Existing Temporary Skill Shortage (subclass 482) visa holders in the short-term stream

- Legacy Temporary Work Skilled (subclass 457) visa holders who no longer meet the age requirement

The government has also extended visas for Skilled Regional (Provisional Visa) holders (subclass 489, 491 and 494), a group that has been affected by COVID-related travel restrictions.

“Current and expired skilled regional provisional visas will be extended, providing additional time to meet regional work requirements for permanent residence…There are currently around 9,000 skilled regional provisional visa holders overseas. These visa holders can enter Australia from 1 December 2021, and they will also be eligible for an extension of their visa.”

Immigration minister Alex Hawke

Growing demand for industrial property

2021 has been a record-breaking year for the Australian industrial and logistics sector, according to Colliers.

In November 2020, investment volumes had already reached $12 billion for the calendar year, which was well above the previous high of $7 billion recorded in 2016. Meanwhile, leasing demand reached 3.7 million sqm in the first three quarters of the year, beating the previous record of 3.3 million sqm in 2020.

National vacancy rates for facilities larger than 5,000 sqm also dropped from 5.1% to 2.8% between the September quarters of 2020 and 2021. During the same period, net face rents jumped 4.3% for the prime market and 5.2% for the secondary market.

According to Colliers, this uptick has largely been driven by the boom in online retail, which has in turn triggered a significant increase in demand for big-box distribution centres and last-mile hubs close to end-consumers.

** General Advice Warning

The information provided on this website is general in nature only and it does not take into account your personal needs or circumstances into consideration. Before acting on any advice, you should consider whether the information is appropriate to your needs and where appropriate, seek professional advice in relation to legal, financial, taxation, mortgage or other advice.