Rateseeker Round-up: September Finance and Business News

September brought about a fresh wave of news in Australia’s business and finance sector.

Over the past month, the Federal Government has made it easier for businesses to secure a loan as part of the SME Recovery Loan Scheme. What’s more, a growing number of Australians have been making the switch from employee to employer. Coupled with a decline in demand for commercial property, and it’s never been a better time to start a business.

Missed the news? Catch up with the three most noteworthy updates from the past month below.

Expanded eligibility for government-backed loans

The Federal Government has expanded eligibility for the SME Recovery Loan Scheme, making it easier for SMBs to get funding.

Previously, businesses needed to have received JobKeeper in the March 2021 quarter or been flood-affected to qualify. This criteria has now been expanded to encompass all businesses that have a turnover of less than $250 million and are dealing with the economic impacts of COVID-19.

Under the scheme:

- Eligible businesses can access loans of up to $5 million over a term of up to 10 years

- The government will guarantee 80% of the loan amount

- Lenders can offer repayment holidays of up to 24 months

- Loans can be either unsecured or secured (excluding residential property)

- Loans can be used for a wide range of purposes, including investment and refinancing

If you’re interested in participating, it’s best to get in now as the scheme is only available until 31 December 2021. Get in touch with us today to get started.

More Australians starting their own businesses

With COVID-19 upending the traditional work environment as we know it, a growing number of Australians are forgoing the 9-to-5 to become their own boss.

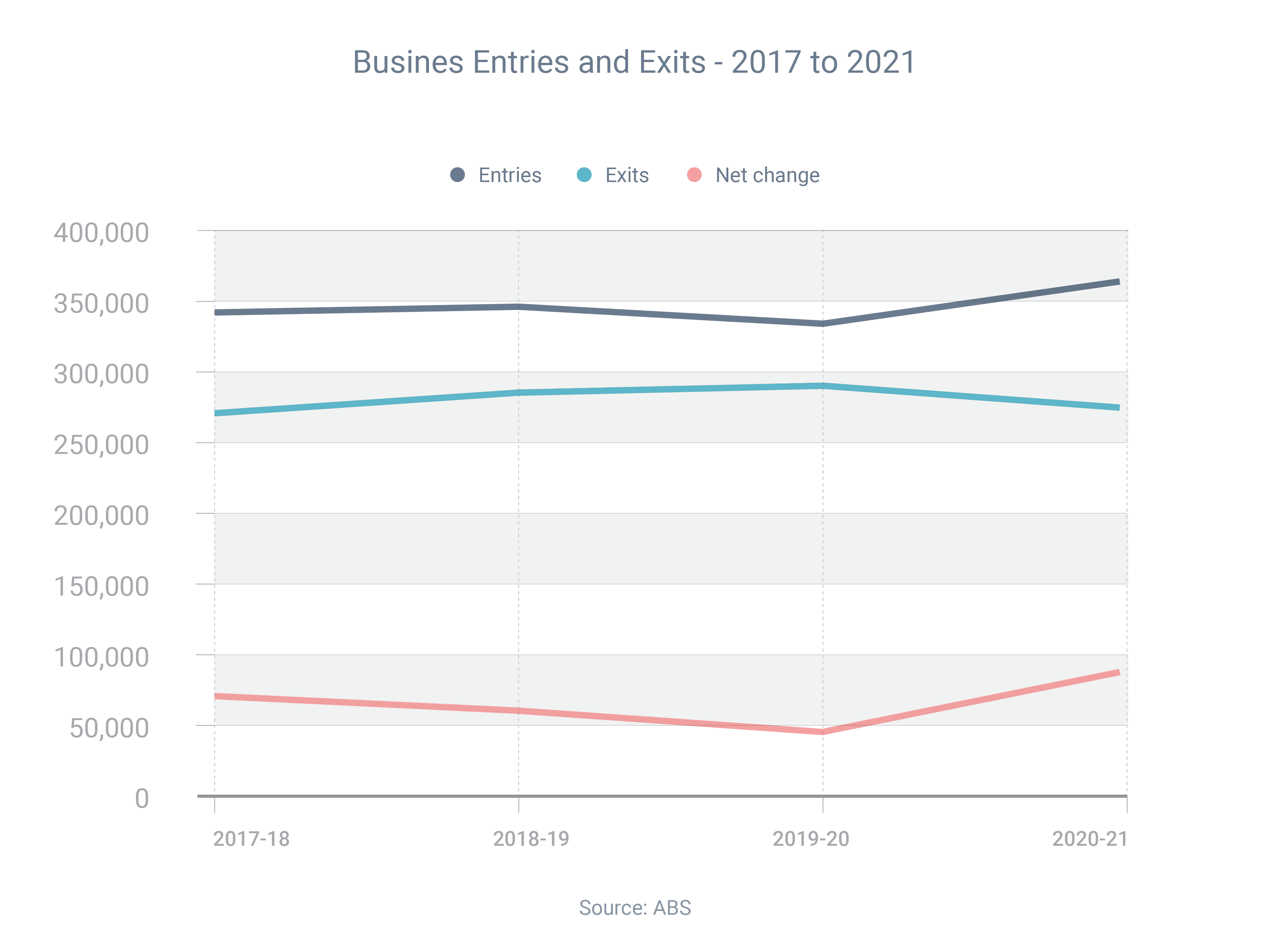

According to the Australian Bureau of Statistics, there were 365,480 business entries in the 2020-21 financial year, which is an increase of 8.6% on the previous year. At the same time, there were 277,674 business exits – a decrease of 4.6%. In total, the number of businesses in operation grew 3.8% to 2,402,254 businesses at the end of the financial year.

In particular, the number of SMBs is growing across the country. The number of businesses with 1-4 employees rose 15.2% during the year, and the number of businesses with 20-199 employees jumped 20.6%.

Whether you’re looking to start a business or expand your existing operations, we’re here to help. Request your obligation-free consultation today and we’ll work with you to secure the sharpest loan for your future plans.

Commercial property market cools

With widespread and continued lockdowns across the country, it’s no surprise that there has been a clear decline in interest for commercial property.

Data from realcommercial.com.au found that national buyer search activity fell 4% between July and August, with the biggest falls in the ACT (-17%), NSW (-8%) and VIC (-7%). All other states also recorded a decrease, except for SA which posted a 2% rise.

Leasing search activity also took a hit during this period, with a steep 10% decrease between July and August. Similar to buyer search activity, the biggest falls were in the ACT (-28%), New South Wales (-16%) and VIC (-12%).

Looking to lease or buy commercial property? With buyer competition falling, now’s the perfect time to snap up a property at a great price. Contact us today to learn more.

** General Advice Warning

The information provided on this website is general in nature only and it does not take into account your personal needs or circumstances into consideration. Before acting on any advice, you should consider whether the information is appropriate to your needs and where appropriate, seek professional advice in relation to legal, financial, taxation, mortgage or other advice.