Rateseeker Round-Up: June Business & Commercial Property News

The new financial year is almost here, and many Australian businesses are reviewing their performance and preparing for FY26. With consumer spending still weak, tax changes on the horizon, and the Reserve Bank adjusting its policy stance, there’s a lot for business owners and investors to consider.

This month’s Rateseeker Round-Up unpacks the latest developments in the economy and commercial property sector, with a spotlight on practical strategies businesses can use to thrive in tighter conditions.

Here’s what we’re covering in this update:

- Household spending stalls, but businesses can still grow

- ATO interest charges lose tax-deductible status from 1 July

- Office vacancies reshape Australia’s parking market

- RBA cuts the cash rate and signals readiness to stimulate further

Let’s get stuck into the details.

Consumers Are Pulling Back: What It Means for Businesses

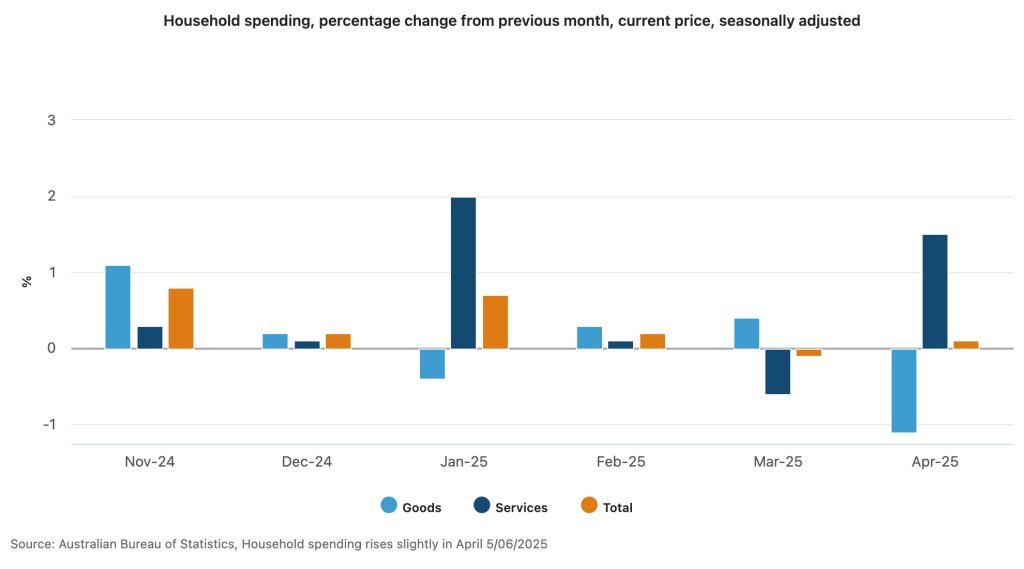

Australian consumers are showing more caution when it comes to spending. The latest Australian Bureau of Statistics (ABS) figures reveal that:

- Household spending in April rose by just 0.1% compared with March.

- Retail sales actually slipped 0.1% month-on-month.

Rising household savings are reinforcing this restraint. The household saving ratio has now risen for three consecutive quarters:

- 2.4% in June 2024

- 3.7% in September 2024

- 3.9% in December 2024

- 5.2% in March 2025

While this shift helps ease inflationary pressures, it also means businesses face lower turnover and more cautious customers.

Why It Matters

Weak consumer demand creates a double-edged environment:

- Positive side: Lower inflation improves the odds of further RBA rate cuts.

- Negative side: Households are less willing to spend, directly affecting business sales and revenue growth.

5 Strategies to Boost Sales in FY26

Businesses can still find opportunities in this climate by focusing on resilience and customer connection:

- Strengthen your online presence. A fast, mobile-friendly, and well-structured website helps convert cautious visitors into paying customers.

- Invest in customer retention. Loyalty programs, personalised offers, and tailored service can drive repeat business at a lower cost than acquiring new customers.

- Refine your pricing strategy. Bundled deals, modest discounts, or tiered pricing can help appeal to cost-conscious households.

- Diversify marketing channels. From social media to local partnerships and email campaigns, reaching customers where they are matters more than ever.

- Offer flexible payment solutions. Buy-now-pay-later, staged payments, or extended terms can ease financial pressure for clients and encourage purchases.

Taking proactive steps now could help your business weather weak demand while positioning for stronger growth once consumer confidence improves.

From 1 July: ATO Interest No Longer Tax-Deductible

One of the biggest upcoming changes for businesses is a tax deduction shake-up.

From 1 July 2025, the Australian Taxation Office’s (ATO) general interest charge (GIC) on overdue tax debts will no longer be tax deductible.

Currently sitting at 11.17% (compounding daily), many businesses had previously treated this interest as a manageable cost. With the change, interest will become a direct hit to your bottom line.

What This Means

- Business owners with outstanding ATO debt will face higher effective costs.

- Relying on tax deductibility to soften the blow will no longer be an option.

- Cash flow planning becomes more important than ever.

How Businesses Can Prepare

To avoid being stung by this change:

- Pay ATO debt quickly. Even partial repayments or short-term plans can reduce the compounding effect of GIC.

- Consider lower-cost finance. A business loan or line of credit may offer cheaper, tax-effective ways to manage obligations.

- Set aside funds regularly. Allocate money each month for GST, PAYG, and superannuation to avoid falling behind.

Getting ahead of this shift will allow businesses to start the financial year on solid footing.

Office Vacancies Are Shaping Parking Prices

Australia’s parking market offers a surprising window into the health of our office property sector.

According to new data from the Ray White Group, parking costs vary widely across capital cities, reflecting differences in office demand:

- Brisbane has overtaken Sydney as the most expensive city for casual parking, with average daily rates at $80.84. The city’s relatively low office vacancy rate (10.2%) has supported strong demand for CBD parking.

- Melbourne, by contrast, has seen parking prices fall back to 2013 levels, with daily rates averaging $64.43. The high vacancy rate of 18% has forced operators to offer deep early bird discounts (62.9%) to attract users.

Why It Matters

- Parking prices are a proxy for office market recovery.

- Stronger CBDs (like Brisbane) are seeing renewed demand, supporting landlords and property owners.

- Weaker CBDs (like Melbourne) continue to struggle, highlighting opportunities for investors who can acquire assets at lower prices but with long-term potential.

If you’re considering investing in commercial property, particularly parking infrastructure, these trends provide valuable context.

RBA Opens the Door to More Stimulus

The Reserve Bank of Australia (RBA) continues to carefully balance economic challenges with policy support.

In its May 2025 meeting minutes, the RBA highlighted:

- GDP growth improved late in 2024 but slowed again in early 2025.

- Household consumption is softer than expected due to weaker real disposable income.

- Unemployment has held steady around 4.1% since mid-2024.

- Wages growth has eased, and voluntary job turnover has declined, reflecting lower worker confidence.

On inflation, the RBA welcomed progress, with the trimmed mean measure back within the 2–3% target range.

To support activity, the Bank reduced the cash rate by 25 basis points to 3.85% and indicated it was willing to cut again if downside risks escalate, especially from global uncertainty.

What This Means for Businesses

- Borrowing costs are already lower and may fall further.

- Businesses with strong balance sheets could benefit from locking in finance at reduced rates.

- Weaker consumer spending may linger, but cheaper capital could support investment and expansion.

Broader Takeaways for FY26

The new financial year presents both challenges and opportunities:

- Cautious consumers are holding back spending, but smart business strategies can still boost sales.

- ATO tax changes mean businesses must rethink how they manage overdue debts.

- Commercial property signals are mixed, with some CBDs strengthening and others struggling.

- The RBA remains supportive, lowering rates and hinting at further action if needed.

For business owners and investors, the key is to stay proactive. Plan for tighter conditions now, but also be ready to seize opportunities as the economy stabilises.

Final Thoughts

Despite softer economic conditions, businesses and investors who adapt quickly can still thrive. The shift in consumer spending, changes to tax treatment, and evolving commercial property trends all demand close attention. As always, Rateseeker is here to help you navigate these changes with clear guidance and tailored finance solutions. Whether you’re planning to refinance, invest in commercial property, or strengthen your business cash flow, our experienced home loan strategists can help make your borrowing journey a stress-free experience.

** General Advice Warning

The information provided on this website is general in nature only and it does not take into account your personal needs or circumstances into consideration. Before acting on any advice, you should consider whether the information is appropriate to your needs and where appropriate, seek professional advice in relation to legal, financial, taxation, mortgage or other advice.