Rateseeker Round-up: April Property News

It’s been a busy month to say the least. The election campaigns are in full swing, inflation is continuing its meteoric surge, and Aussies are bracing themselves for a much-anticipated rate rise in the near future.

Missed the news from April? Catch up on the four biggest property news stories from last month below.

Government expands federal housing initiatives

Feel like you’re never going to get a foot on the property ladder? Good news: the federal government has expanded support to first home buyers and single parents, and has also released a new program for regional buyers.

The First Home Loan Deposit Scheme and New Home Guarantee, which currently support a combined 20,000 first home buyers per financial year, will now support 35,000 places per year from July 1. The price caps for these programs, which differ from area to area, will also be increased by anywhere from $50,000 to $250,000. Under these two programs, eligible first home buyers can purchase properties with just a 5% deposit, without needing to pay Lender’s Mortgage Insurance (LMI).

However, the Family Home Guarantee will now support 5,000 single parents per year from July 1, instead of the 10,000 spots it had previously. Under this program, single parents can buy properties with just a 2% deposit.

The Federal Government has also introduced the new Regional Home Guarantee, which will help 10,000 people per financial year to buy a property in a regional area with just a 5% deposit. Starting from October 1, this program is open to first home buyers, people who have not owned a home for at least five years and permanent residents.

Sharp rise in homebuilding costs

Ongoing supply chain issues have triggered a sharp rise in residential construction costs, with CoreLogic’s Cordell Construction Cost Index reporting that national costs increased 9.0% over the 12 months to March 2022. That was the highest annual growth rate on record apart from the introduction of the GST in 2001.

“Timber costs continue to rise, with cladding, decking and other timber items affected. Steep rises in metal prices are also now flowing through to the market, with structural steel, fixings and metal components hit hard. We continued to see volatility in the rest of the market, with imported products the most vulnerable due to elevated shipping costs. Rising fuel costs are also on the radar and we have continued to see further increases in the cost of other materials.”

John Bennett, CoreLogic construction cost estimation manager

It’s hard to know whether the growth in construction costs is trending up or down: costs rose 2.4% in the first quarter of 2022, which was significantly higher than the previous quarter (1.1%) but lower than the quarter before that (3.8%). However, one thing is for certain: Australians are having to pay more money to build or buy new homes.

With costs rising, it’s more important than ever to seek the sharpest rate for your construction loan. Get in touch with us today and we’ll help you find the best option for your personal and financial situation.

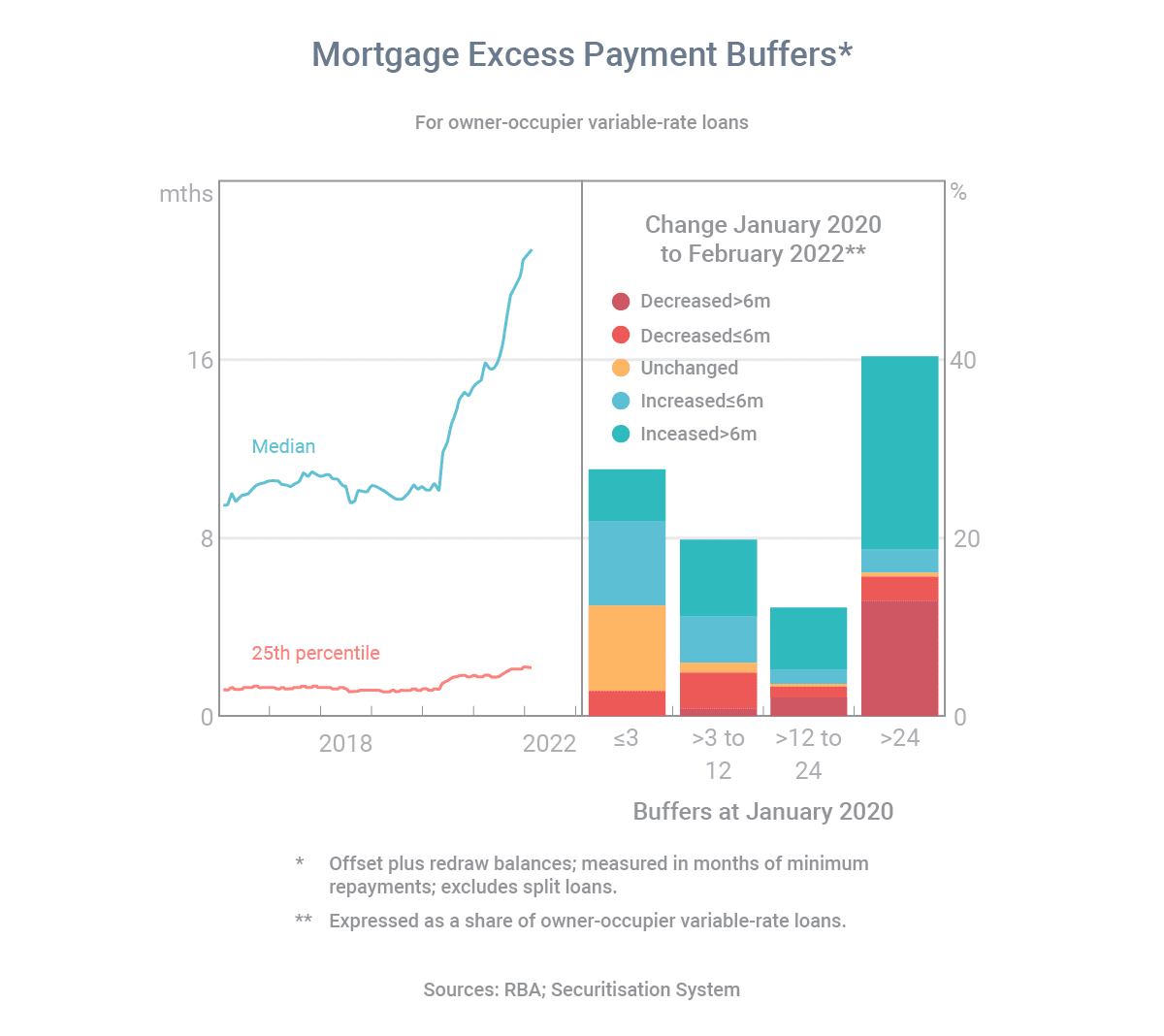

The median repayment buffer has doubled from 10 to 21 months

Aussie mortgage holders are largely prepared for impending rate rises, according to the Reserve Bank of Australia’s (RBA) latest half-yearly Financial Stability Review.

Between February 2020 and February 2022, many borrowers built up big repayment buffers by paying extra money into their offset and redraw accounts. During those two years, the median buffer for owner-occupiers with a variable-rate loan increased from about 10 months of repayments to about 21 months. This means that even if interest rates rise, most mortgage holders should be in a good position to handle increased repayments.

In further good news, the share of loans in negative equity (i.e. where the loan exceeds the value of the property) has also significantly improved during the two-year period, falling from 2.25% to less than 0.25%.

Interest rates forecast to rise

The big four banks have forecast that the Reserve Bank will begin lifting official interest rates from June. If and when that happens, lenders will almost certainly increase their home loan rates.

If you’re about to start looking for a property and planning to get a fixed-rate loan, this may be particularly challenging as it’s possible fixed rates will rise between when you get your pre-approval and when you formally apply for your home loan.

In that case, you’d have to accept the higher interest rate – unless you’d taken out a ‘rate lock’, which is when a bank promises to give you the lower initial interest rate in return for a fee.

Rate locks, like all insurance policies, are priced so that the provider (i.e. the bank) finishes ahead. So, for the average borrower, the cost of the rate lock is likely to be higher than the savings it provides. But a rate lock can still be valuable by providing peace of mind.

Wondering whether a rate lock is worth it? Contact us and we’ll help you decide which option is most suitable for you.

** General Advice Warning

The information provided on this website is general in nature only and it does not take into account your personal needs or circumstances into consideration. Before acting on any advice, you should consider whether the information is appropriate to your needs and where appropriate, seek professional advice in relation to legal, financial, taxation, mortgage or other advice.